Amazon’s Customer-first Focus Could Reshape the Pharma Supply Chain

With all of Amazon’s health care moves, it’s been tough to get a precise read on exactly where the company is headed. But when it comes to the pharmaceutical supply chain, look for Amazon to become an end-to-end player.

Within five years, the online retail giant through acquisitions and other investments, could become active in wholesale, pharmacy benefit management, operating pharmacies through its 450 Whole Foods stores and perhaps even manufacturing. In the process, Amazon could leverage its Prime membership services and Alexa to expand into more areas of the pharmaceutical business.

Joshua Mark, an intelligence analyst with CB Insights, laid out the case for Amazon’s aggressive expansion through acquisitions and other means during the firm’s recent Future of Health conference. The conference explored issues such as how technology is addressing the women’s health market, the future of aging and CB Insights revealed its Digital Health 150 list of startups that are redefining health care.

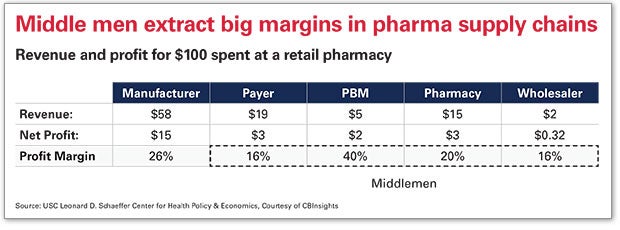

Mark believes the $1.2 trillion pharmaceutical supply chain is ripe for disruption as middlemen extract huge margins before drugs make their way to consumers. He argued that Amazon is uniquely positioned to fundamentally alter current market conditions.

With more than half of all Americans now Amazon Prime members, Amazon has a larger negotiating base than any insurer or payer today, Mark said. Moving into the wholesale space is a logical move. If the company does this, it can provide service as a pharmacy benefit manager for self-insured employers and other payers who are unhappy with the status quo — as many indicated in a National Pharmaceutical Council report.

With its customer-first mission, Amazon could well follow the model of GoodRx, which aggregates prices available at local pharmacies and points customers to the lowest price regardless of who sells it. Mark noted that Alexa may become the front door to the patient experience. Earlier this year Alexa added six HIPAA-compliant skills, including allowing members of Express Scripts to check on the status of home delivery prescriptions and to send notifications when prescriptions have been shipped and when they arrive. Amazon also could follow the models of Nurx, hims and Pill Club in shipping drugs prescribed through a telehealth visit with a physician directly to a patient’s door.

In addition, Amazon might look at acquiring a generic pharmaceutical manufacturer like Teva Pharmaceutical Industries, whose stock is down 80% over the last five years, as a launch point for a private-label generic drug opportunity, Mark said.

If all this sounds like too-much, too-fast, even for a company the size of Amazon, Mark explained that another company — Alibaba already has done this in China, adding that Amazon has a history of copying some of Alibaba’s moves, such as its Prime Day offering and entrance into the grocery space.

What Amazon’s future in pharma would mean

Mark indicated the following ramifications for health care providers, payers and drugmakers as Amazon further expands into the pharmaceutical market:

Providers

They would see lower-cost drugs across care settings, regardless of scale. Secondly, because Amazon would be a competitor in prescription health services, providers may look to simplify their prescription process in order to compete with what could be a better patient experience from Amazon.

Payers

It may mean that Amazon ends up offering a better drug benefit than payers. The premium payers capture today comes in the form of a drug benefit. If Amazon offers a better drug benefit than payers, customers don’t have to buy it from insurers going forward. This will squeeze payers to either lower their prices or find another source of revenue.

Therapeutics Makers

Amazon becomes the ideal partner to end all therapeutics makers’ needs for warehousing and distribution services.