Massive Growth in Expenses & Rising Inflation Fuel Financial Challenges for America’s Hospitals & Health Systems

For over two years since the outset of the COVID-19 pandemic, America’s hospitals and health systems have been on the front lines caring for patients and protecting communities. With over 80 million cases, nearly 1 million deaths, and over 4.6 million hospitalizations, the pandemic has taken a significant toll on hospitals and health systems and placed enormous strain on the nation’s health care workforce.

Hospitals and health systems have repeatedly confronted a range of financial and operational challenges, including historic volume and revenue losses, as well as skyrocketing expenses. When coupled with rising inflation and growth in input prices, these expense increases have been severely detrimental to hospital finances, leading to billions in losses and over 33% of hospitals operating on negative margins.

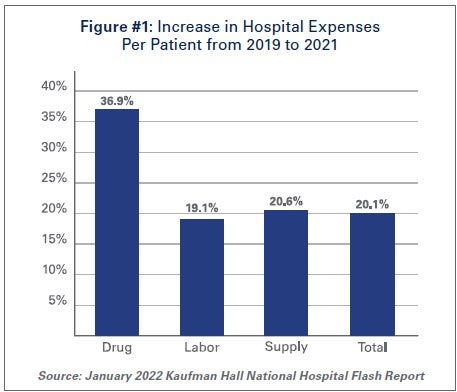

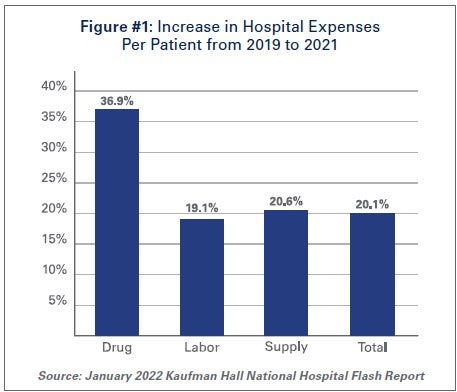

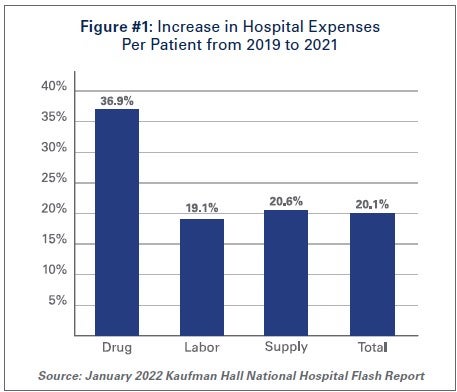

A new AHA report highlights the significant growth in expenses across labor, drugs, and supplies (see chart), as well as the impact that rising inflation is having on hospital prices. View the full report. Other data highlights are below.

A new AHA report highlights the significant growth in expenses across labor, drugs, and supplies (see chart), as well as the impact that rising inflation is having on hospital prices. View the full report. Other data highlights are below.

- According to data from the Bureau of Labor Statistics, hospital employment is down approximately 100,000 from pre-pandemic levels. At the same time, hospital labor expenses per patient through 2021 were 19.1% higher than pre-pandemic levels in 2019. Labor costs account for more than 50% of hospitals’ total expenses. Therefore, even a slight increase in these costs can have significant impacts on a hospital’s total expenses and operating margins.

- Driving the growth in labor expenses has been an increased reliance on contract staff, especially contract nurses, who are integral members of the clinical team. In 2019, hospitals spent a median of 4.7% of their total nurse labor expenses for contract travel nurses, which skyrocketed to a median of 38.6% in January 2022.

- Contract staff agencies have increased the rates they bill hospitals significantly. In fact, hourly billing rates that hospitals pay staffing firms for contract employees increased 213% compared to pre-pandemic levels and led to a 62% profit margin for contract staff agencies, i.e., the difference between what the firms charge hospitals and what the firms actually pay the contract employees.

- Drug expenses also increased dramatically, 36.9% on per patient bases, compared to pre-pandemic levels. As a share of non-labor expenses, drug expenses grew from approximately 8.2% in January 2019 to 10.6% in January 2022.

- Medical supply expenses grew 20.6% through the end of 2021, compared to pre-pandemic levels. When focusing on hospital departments most directly involved in care for COVID-19 patients − ICUs and respiratory care departments − medical supply expenses increased 31.5% and 22.3%, respectively, from pre-pandemic levels.

- Higher economy-wide costs have important effects on hospital and health system prices. In April 2021, BLS reported that the CPI-U had the largest 12-month increase since September 2008 and consumer prices rose by a historic 8.5% in March 2022. Despite persistent cost pressures, hospital prices have seen consistently modest growth in recent years. According to BLS data, hospital prices have grown an average 2.1% per year over the last decade, about half the average annual increase in health insurance premiums.

Additional Federal Support Needed

With additional surges potentially on the horizon and case rates rising once again, the massive growth in expenses is unsustainable. Most of the nation’s hospitals and health systems were operating on razor-thin margins prior to the pandemic; and now, many of these hospitals are in an even more precarious financial situation. Hospitals appreciate the support and resources that Congress has provided throughout the pandemic; however, additional support is needed now so hospitals can provide care to the patients and communities they serve.