Skyrocketing Hospital Administrative Costs, Burdensome Commercial Insurer Policies Impacting Patient Care

While the impact of cost increases for drugs, supplies, and labor on health care providers has been well-documented, the costs associated with excessive regulatory and insurer requirements has been less studied, but is equally challenging. In addition to navigating the complex web of federal and state regulatory requirements, hospitals face increasingly burdensome insurer policies. These include securing prior authorization for a growing array of services as well as use of step therapy or fail-first policies that delay patients getting the most appropriate care, to name just a few. Many hospitals and health systems are forced to dedicate staff and clinical resources to appeal and overturn inappropriate denials, which alone can cost billions of dollars every year. Recent data from Strata Decision Technology show that administrative costs now account for more than 40% of total expenses hospitals incur in delivering care to patients.

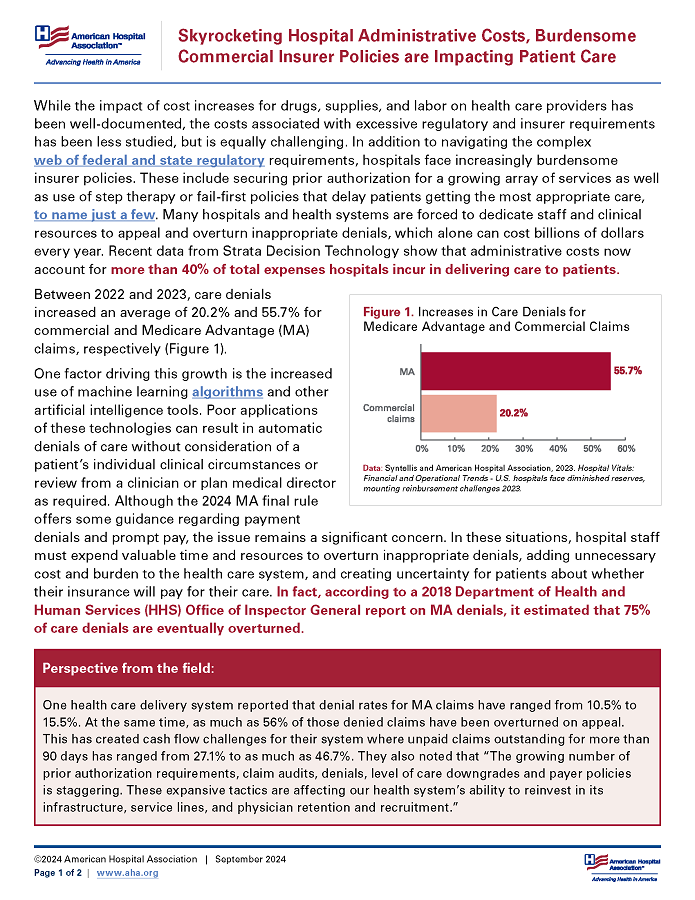

Between 2022 and 2023, care denials increased an average of 20.2% and 55.7% for commercial and Medicare Advantage (MA) claims, respectively (Figure 1).

One factor driving this growth is the increased use of machine learning algorithms and other artificial intelligence tools. Poor applications of these technologies can result in automatic denials of care without consideration of a patient’s individual clinical circumstances or review from a clinician or plan medical director as required. Although the 2024 MA final rule offers some guidance regarding payment denials and prompt pay, the issue remains a significant concern. In these situations, hospital staff must expend valuable time and resources to overturn inappropriate denials, adding unnecessary cost and burden to the health care system, and creating uncertainty for patients about whether their insurance will pay for their care. In fact, according to a 2018 Department of Health and Human Services (HHS) Office of Inspector General report on MA denials, it estimated that 75% of care denials are eventually overturned.

Perspective from the Field

One health care delivery system reported that denial rates for MA claims have ranged from 10.5% to 15.5%. At the same time, as much as 56% of those denied claims have been overturned on appeal. This has created cash flow challenges for their system where unpaid claims outstanding for more than 90 days has ranged from 27.1% to as much as 46.7%. They also noted that “The growing number of prior authorization requirements, claim audits, denials, level of care downgrades and payer policies is staggering. These expansive tactics are affecting our health system’s ability to reinvest in its infrastructure, service lines, and physician retention and recruitment.”

A study by McKinsey found that hospitals and health systems are conservatively spending an estimated $40 billion annually on costs associated with billing and collections. Even when denials are successfully overturned, commercial insurers impose other roadblocks to timely payment of claims.

The time taken by commercial payers simply to process and pay hospital claims from the date of submission increased by 19.7% in 2023, according to data from the Vitality Payer Scorecard. Additionally, commercial insurers use post-payment claims audits to cut reimbursement to hospitals or otherwise unilaterally recoup payments after-the-fact. These unfair business practices create cash flow challenges for hospitals that threaten the viability of many community providers. An AHA survey found that 50% of hospitals and health systems reported having more than $100 million in accounts receivable for claims that were older than six months in 2022.

These cash flow challenges also are exacerbated when cyberattacks cripple the claims processing and payment systems that hospitals and insurance companies rely on as evidenced by the recent Change Healthcare attack. The risk of such cybersecurity threats also adds to the administrative costs hospitals incur to operate, maintain and update the complex technologies that are required for hospital billing and collections.

Conclusion

Hospitals and health systems already face many pressures that make their ability to care for communities more challenging. We shouldn’t allow insurers or others to add to that with costly administrative practices that burden already overwhelmed health care professionals and decrease patient access to care. For more on the financial challenges facing hospitals and health systems, see AHA’s Cost of Caring Report.