Data Brief: Workforce Issues Remain at the Forefront of Pandemic-related Challenges for Hospitals

As we enter the third year of the COVID-19 pandemic, the nation is currently experiencing one of the worst surges of the virus due to the omicron variant, which has resulted in skyrocketing numbers of COVID-19 cases, deaths and hospitalizations. As of January 2022, there have been over 70 million COVID-19 cases and nearly 900,000 deaths in the U.S., with over 20 million cases and approximately 100,000 deaths in just the last two months.

Our nation’s hospital and health system workers have been on the front lines of this crisis since the outset, caring for millions of patients, including over 4 million inpatients with COVID-19. During this time, hospitals have continued to face a range of financial and operational pressures, with workforce-related challenges among those most critical.

Though managing workforce pressures were a challenge for hospitals even before the pandemic, these challenges have only grown more acute. The incredible toll that hospital workers have endured in caring for patients during the pandemic has undoubtedly led to burnout among other issues which have contributed to exacerbating the shortage of hospital workers. In fact, this shortage has become so critical that some states and the federal government have deployed military and national guard resources to help mitigate staffing challenges at hospitals. As this shortage has worsened and COVID-19 hospitalizations have reached record levels, labor costs for hospitals have increased dramatically. This combination of factors have been exploited by health care staffing companies and other firms that provide contract labor resources, driving up workforce costs even more for hospitals. Hospitals also have incurred significant costs in recruiting and retaining staff, which have included overtime pay, bonus pay and other incentives. This is occurring at a time when many hospitals and health systems are still facing other immense financial constraints. For many hospitals around the country this has led to an unsustainable situation that threatens their ability to care for the patients and communities they serve.

As demand for hospital care remains high and patient acuity for both COVID-19 and non-COVID-19 care has increased, hospitals are facing a critical shortage of workers necessary to meet that demand.

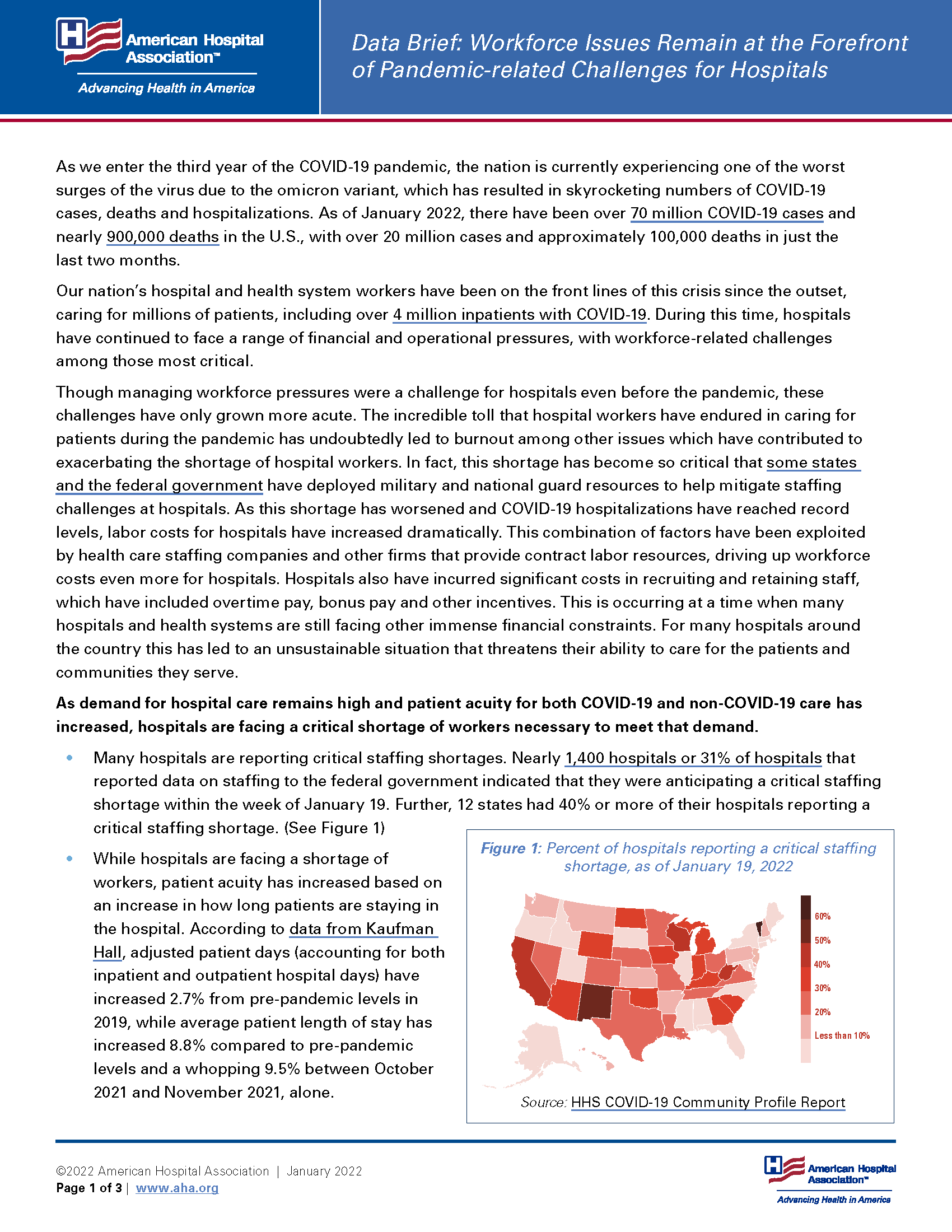

Many hospitals are reporting critical staffing shortages. Nearly 1,400 hospitals or 31% of hospitals that reported data on staffing to the federal government indicated that they were anticipating a critical staffing shortage within the week of January 19. Further, 12 states had 40% or more of their hospitals reporting a critical staffing shortage. (See Figure 1)

Many hospitals are reporting critical staffing shortages. Nearly 1,400 hospitals or 31% of hospitals that reported data on staffing to the federal government indicated that they were anticipating a critical staffing shortage within the week of January 19. Further, 12 states had 40% or more of their hospitals reporting a critical staffing shortage. (See Figure 1)- While hospitals are facing a shortage of workers, patient acuity has increased based on an increase in how long patients are staying in the hospital. According to data from Kaufman Hall, adjusted patient days (accounting for both inpatient and outpatient hospital days) have increased 2.7% from pre-pandemic levels in 2019, while average patient length of stay has increased 8.8% compared to pre-pandemic levels and a whopping 9.5% between October 2021 and November 2021, alone.

- Nurses, who are critical members of the patient care team, are one of the many health care professions that are currently in shortage. In fact, a study found that the nurse turnover rate was 18.7%, illustrating the magnitude of the issue facing hospitals and their ability to maintain nursing staff. The same study also found that 35.8% of hospitals reported a nurse vacancy rate of greater than 10%, which is up from 23.7% of hospitals prior to the pandemic. In fact, two-thirds of hospitals currently have a nurse vacancy rate of 7.5% or more.

- Hospital employment has continued to decline compared to pre-pandemic levels. According to data from the Bureau of Labor Statistics (BLS), hospital employment is down 95,600 employees from February 2020.

To help mitigate critical staffing challenges, hospitals have been forced to make more extensive use of expensive contract labor firms for a variety of health care staff to ensure patient care and overall hospital operations are not compromised.

- Almost every hospital in the country has been forced to hire temporary contract staff to maintain operations at some point during the pandemic. According to a survey by AMN Healthcare, 95% of health care facilities reported hiring staff from contract labor firms, with respiratory therapists being the primary need for many hospitals.

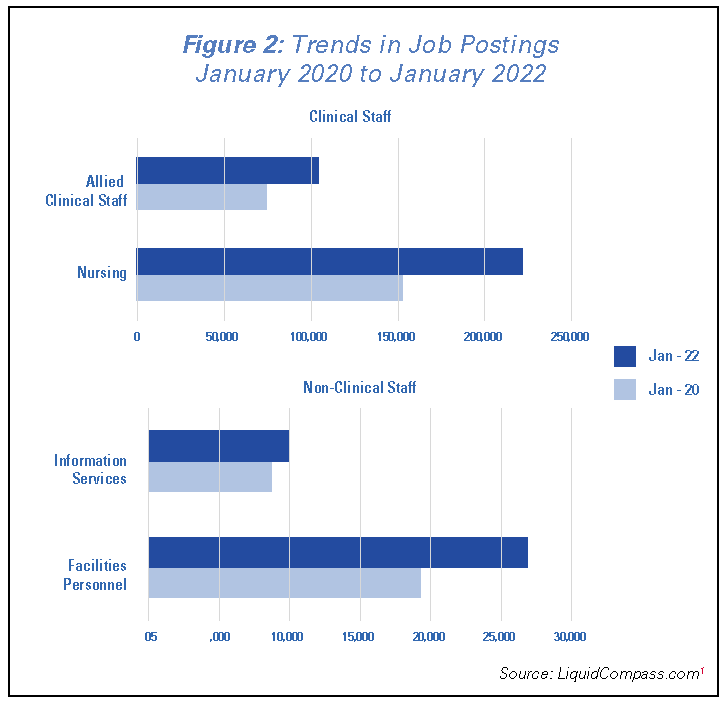

As hospitals have looked to bring in more staff, job postings for both clinical and non-clinical staff have increased from pre-pandemic levels. Based on data from Liquid Compass analyzed by Prolucent Health, job postings for clinical staff have increased by 45% for nurses and 41% for other allied clinical staff between January 2020 and January 2022. At the same time, non-clinical staff such as environmental service and facilities workers, who play in important role in maintaining hospital operations, have seen job postings increase of nearly 40%. (See Figure 2)1

As hospitals have looked to bring in more staff, job postings for both clinical and non-clinical staff have increased from pre-pandemic levels. Based on data from Liquid Compass analyzed by Prolucent Health, job postings for clinical staff have increased by 45% for nurses and 41% for other allied clinical staff between January 2020 and January 2022. At the same time, non-clinical staff such as environmental service and facilities workers, who play in important role in maintaining hospital operations, have seen job postings increase of nearly 40%. (See Figure 2)1- Hospitals were already spending more money on contract labor even before the latest COVID-19 surge. According to a Definitive Healthcare study, contract labor expenses for hospitals have more than doubled over the last decade.

- Contract labor firms are charging exorbitant prices for nurses as supply is scarce and demand is at an all-time high. For example, average pay for hospital contract nurses has more than doubled compared to pre-pandemic levels. According to Prolucent Health, there has been a 67% increase in the advertised pay rate for travel nurses from January 2020 to January 2022, and hospitals are billed an additional 28%-32% over those pay rates by staffing firms. In fact, in some areas pay rates for travel nurses have been as high as $240/hour or more, which have contributed to the dramatic increase in hospitals' labor costs.

- Hospital labor expenses are much higher than pre-pandemic levels. Labor expenses are up 12% on an absolute basis, and 19.5% on a per adjusted discharge basis compared to levels in 2019. Purchased service expenses, which include contract labor, are up over 20% on a per adjusted discharge basis, indicating the sizeable growth in hospital expenses related to acquiring staff from contract labor firms. These increases reflect both the increased cost of labor and the higher acuity of patients in the hospital.

Rising hospital labor costs have had broad impacts on overall hospital finances, further lowering operating margins and pushing many hospitals closer to their financial brink.

- As total hospital expenses have risen 19.9% on a per adjusted discharge basis, operating margins have declined. Median operating margins are down nearly 4% compared to pre-pandemic levels in 2019.

- As hospitals have sought to hire more staff to meet demand, they have had to incur more expenses, including the need to purchase additional personal protective equipment and other supplies to adequately protect their staff. Supply expenses have increased 20.5% per adjusted discharge compared to prepandemic levels.

- Credit rating agency, Moody’s gave the nonprofit and public health care sector a negative outlook, in large par due to rising labor costs, which they said could decrease operating cash flow up to 9%. In fact, labor costs now account for over 50% of hospitals' total expenses.

- Many hospitals have been forced to temporarily shut down certain procedures or units within the hospital (e.g., intensive care units and labor and delivery) and divert patients to other facilities due to staffing shortages.

With COVID-19 hospitalizations reaching record highs, the staffing crisis currently plaguing our nation’s hospitals is only expected to worsen. In fact, according to BLS data for nurses alone, it is anticipated that 500,000 nurses will leave the workforce in 2022, bringing the overall shortage to 1.1 million nurses. These data highlight the need to develop and implement longer-term solutions to avoid the further deepening of this crisis, which includes investing in more opportunities and slots for health care workers in the pipeline.

Our workforce challenges are a national emergency that demand immediate attention. Without a resilient and sufficient health care workforce, our hospitals – the backbone of our nation’s health care system – will be unable to operate. It is imperative that we address this immediate staffing crisis with long-term solutions that can support a robust health care workforce. The AHA continues to support policies that would provide behavioral health services for healthcare workers to prevent burnout, lifting caps on training slots and increasing funding for direct and indirect graduate medical education, and supporting local and state laws to bolster the ability of staff to work at the top of their license. In addition, the AHA believes it is important for Congress and the Administration to increase regulatory scrutiny on staffing agencies to address anticompetitive behavior, as well as health insurers' burdensome practices that add to provider burnout and divert staff away from patient care. We must work together to solve these issues so that our nation’s hospitals and health systems can continue to care for the patients and communities they serve.

For more information on workforce resources by the AHA, please visit: aha.org/workforce-home.

- The LiquidCompass Market Console is a comprehensive database that scrapes, aggregates and analyzes job postings across the entire health care industry on a real time basis, providing valuable and timely insights to employers and a comprehensive job search experience for job seekers. Market Console provides the health care industry with valuable employment trends and data that can help ensure a more stable healthcare workforce. LiquidCompass.com is one of many technology-enabled workforce optimization products and services developed by Prolucent Health. Prolucent Health is a data and technology company that offers comprehensive labor management tools and services targeting the healthcare industry’s most significant workforce challenges.