5 Health Care Workforce Shortage Takeaways for 2028

Projections on potential health care workforce shortages came fast and furious during the pandemic and after the public emergency expired. So, what should the field make of all this data?

A new study based on research conducted by the Mercer consultancy and its partner Lightcast projects changes to the U.S. health care labor market by 2028 by state and metro and micro statistical areas.

The study’s projections and analysis provide context to some of the more nuanced shortages among the clinical workforce and which states may be impacted most and least by shifting market conditions, demographics and other influences.

5 Key Findings on Coming Workforce Changes

1 | Expect a shortage of about 100,000 critical health care workers by 2028.

The impact of the shortages will be uneven and an added burden to a system strained by geographic and demographic disparities in access to care, the report states. Populous states like California, Texas and Pennsylvania are expected to weather the storm with the estimated labor supply exceeding demand. Acute shortages are projected, however, in states like New York and New Jersey.

2 | Shortage of nurse assistants (NAs) may be severe.

Only 13 states are expected to meet or exceed future demand and Mercer forecasts a shortage of about 73,000 NAs by 2028. Because NAs make up a large share of the overall health care workforce, these projected shortages warrant close attention.

3 | Gaps may differ widely by state on registered nurse availability.

Mercer projects a slight surplus of RNs by 2028. This is counter to many other projections by experts who forecast a shortage of nurses. Mercer does project nursing shortages for New York and other East Coast states.

4 | Modest surplus of physicians expected nationally.

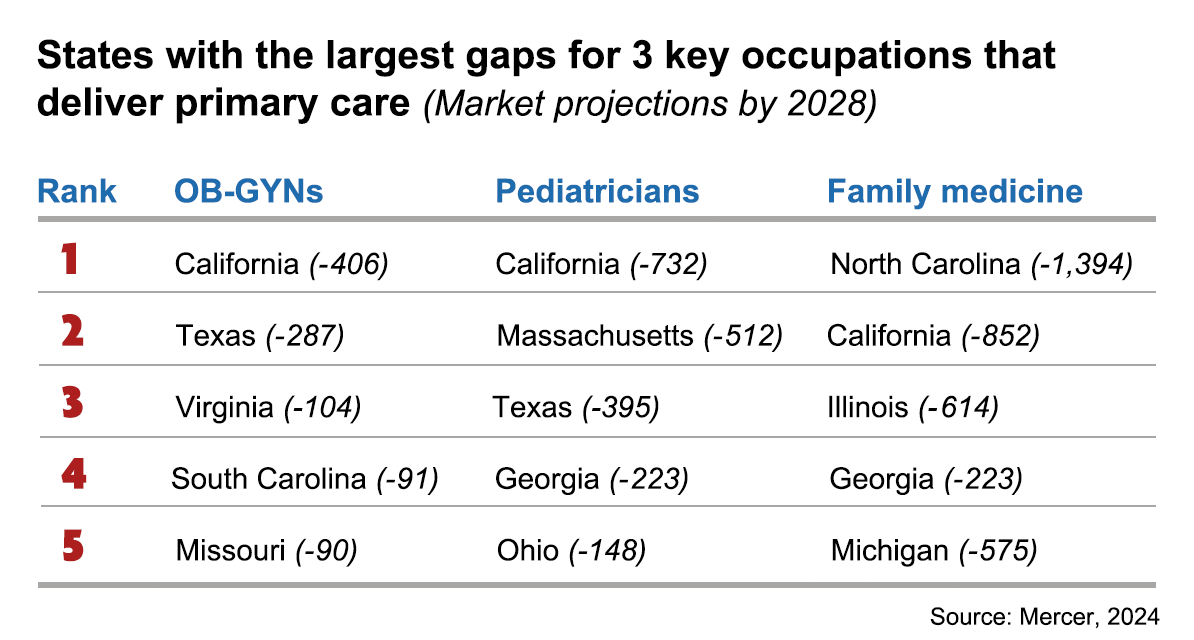

While research and popular discussions have predicted physician shortages in the U.S. under different scenarios, the report’s authors expect a surplus of about 28,000 doctors. The authors based their findings on the Bureau of Labor Statistics standard occupation codes for all physician jobs. While some states may find a modest surplus of physicians by 2028, states like California (-2,580), Texas (-2,830) and New York (-2,706) could see sizable shortages and the combined impact of shortages for both NPs and physicians may result in significant disruptions to the continued delivery of preventive care.

5 | Compensation variation could lead some workers to move.

Understanding compensation variation by occupation and geography is crucial to prepare for potential shortages. If NAs can earn more for doing the same job by moving to a neighboring state, or even a metropolitan area, they may choose to relocate, the authors note.

3 Talent Areas to Focus on Now

Given that workforce challenges are not going away any time soon, the authors suggest focusing on these key areas to address ongoing talent needs. And remember, provider organizations aren’t only competing with other health care employers but often with other fields — particularly when filling lower-wage support positions that are vital to the overall delivery of quality patient care.

One: Assess your specific supply/demand risk by occupation and department.

Project internal demand for critical occupations due to attrition, expansion of services and evaluate demand against projected supply. Determine where the greatest risks lie for not filling vacant positions promptly.

Some occupations are more critical than others and will require special attention and investment. Develop an understanding of the local labor market for these critical roles. If there is not a sufficient local labor market to fill critical shortages, discuss needed steps to address the situation.

Two: Rethink sourcing strategies and processes.

To ensure a consistent pipeline of talent in your local market, consider collaborating on investment in occupational development, increasing educational capacity and reviewing compensation. These include expanding your current talent acquisition efforts, internal training and graduate pipeline. You may need to pivot recruitment beyond current boundaries to meet talent where it is. Explore ways to build talent internally through training, development and certification programs. This takes time and requires proactive decision-making and a planned investment.

Three: Ensure the well-being of existing employees.

This can help improve retention and reduce burnout among staff — a common source of attrition in health care. Monitor the marketplace and fine-tune the employee value proposition with respect to pay and benefits, schedule flexibility, career growth opportunities and job satisfaction. The AHA’s webpage, Building a Systemic Well-Being Program: 5-Step Blueprint, provides a step-by-step resource for health care leaders.

Learn More

The AHA’s American Organization for Nursing Leadership Workforce Compendium provides a wealth of best practices and innovations to help leaders strategize and manage the complexities of the nursing workforce. Separate chapters are devoted to talent attraction and acquisition and recruitment and retention. The AHA’s Workforce webpage also provides a multitude of resources to help hospitals and health systems address staffing issues.