Health System Venture Funds Place Their Bets on Innovation

With ever-increasing frequency, hospitals and health systems are establishing or expanding venture funds in search of the next startup that could revolutionize health care. Consider some recent transactions.

Becker’s Health IT recently reported that Kaiser Permanente Ventures joined the $160 million funding round for Freenome, a blood-test startup focused on early cancer detection. In June, Atrium Health, Cleveland Clinic and the California-based MemorialCare Innovation Fund invested $3 million in Xealth (an integrated digital prescribing and analytics platform) to complete its $14 million round of Series A financing, along with investments from Providence St. Joseph Health, UPMC, Froedtert and the Medical College of Wisconsin. A month earlier, Iowa-based UnityPoint Health launched a $100 million venture fund to focus on early-stage growth companies in digital health, medical device, therapeutic spaces and health care services.

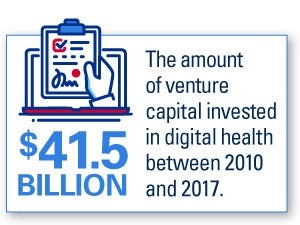

This is no recent phenomenon, as Health Affairs pointed out earlier this year. It noted that between 2010 and 2017, the value of investments in digital health alone increased by 858%, with more than $41.5 billion invested in the sector this decade. In addition, venture capital is steadily flowing into areas like drug development, medical devices, systems to improve population health management, diagnostics and precision medicine.

What’s driving provider organizations to create and expand their venture funds is what led many of them to drive and reward innovation in their own systems: to test and scale solutions that seek to improve the quality of care, positively impact population health initiatives and lower health care costs. These innovation investments can create commercial returns and, ultimately, help fund more research and development in health systems.

What’s driving provider organizations to create and expand their venture funds is what led many of them to drive and reward innovation in their own systems: to test and scale solutions that seek to improve the quality of care, positively impact population health initiatives and lower health care costs. These innovation investments can create commercial returns and, ultimately, help fund more research and development in health systems.

To explore where some of the largest health system venture groups are putting their capital, Market Scan researched the following health system fund groups.

Ascension Ventures: With more than $800 million in capital under management, this fund represents the organization’s health care limited partners including Trinity Health, Mercy, Catholic Health Initiatives and others. The fund has invested in more than 65 companies that make medical devices, clinical software, tools to improve clinical staff and resource optimization, pharmacy management, population health and remote care solutions.

Cleveland Clinic Ventures: After Cleveland Clinic’s prolific history of launching more than 80 startup companies since 2000 and earning returns on its exited companies, the CCV fund was formed in 2017 to invest in emerging health care companies. It operates in tandem with the Cleveland Clinic Innovations arm. Cleveland Clinic Ventures’ investment focus includes innovation based on intellectual property development at the Cleveland Clinic, as well as companies that drive strategic value and address its priorities in areas like patient experience; safety and outcomes; caregiver engagement; population health management and the shift to value-based care; precision medicine; and distance health solutions.

Intermountain Ventures: Established earlier this year, this $80 million fund invests in innovative companies with high growth and potential for return on investment. The fund’s minimum investment size is $1 million, with a target of $3 million to $5 million over the life of the portfolio company. To date, the fund has invested in solutions to address patient-specific diagnoses and treatments based on their DNA; a service to identify at-risk and complex patients that facilitates collaboration to improve outcomes; and innovative diagnostic tests focused on the early prediction of preterm birth risk and other pregnancy complications.

Kaiser Permanente Ventures: The Kaiser Permanente Ventures (KPV) team has invested in and supported more than 65 companies since the first fund was founded more than 20 years ago. CB Insights reports that KPV manages $400 million in assets over four funds. These funds target health information technology, digital health, medical devices, diagnostics and precision medicine and health care services. Liz Rockett, director of Kaiser Permanente Ventures, recently told a crowd at the AHIP Institute & Expo that KPV thinks about how a product or technology will fit into the full spectrum of patient care rather than a static entry point and looks for companies that have demonstrated that patients will use the product.

Mayo Clinic Ventures: The group commercializes Mayo Clinic’s discoveries to benefit patients around the world while generating revenue to support clinical practice, research and education. It accounted for 5% of Mayo Clinic’s operating net income of $706 million in 2018. Focusing largely on the advancement of health-related technologies, Mayo Clinic Ventures receives more than 700 ideas per year, about one-third of which move forward into some form of development. Since its inception, the group has made more than 60 investments in such areas as diagnostics, therapeutics, imaging, medical devices and clinical software.