The Essential Role of Financial Reserves in Not-for-Profit Healthcare

April 2023

Introduction

Anyone unfamiliar with the financial structure of not-for-profit hospitals and health systems may question why these organizations carry often significant financial reserves on their balance sheets. The answer is straightforward: with limited sources of funding, hospitals and health systems rely on financial reserves to maintain their financial stability and support their growth. These reserves ensure that hospitals and health systems can continue to serve their communities through good times and bad and can continue to invest in the highly skilled professionals and lifesaving technologies that define modern healthcare.

Not-for-profit hospitals and health systems have essentially two sources of funding: they either earn revenue from operations and investments (providing patient services makes up most of this revenue) or they borrow funds through issuance of debt in the bond markets or other forms of borrowing (e.g., bank lines of credit).1 Unlike for-profit organizations, they do not have access to equity markets. Also, unlike for-profit organizations, they are not obligated to shareholders who expect that excess funds will be distributed as dividends. Instead, not-for-profit hospitals and health systems have an obligation to their mission and the communities they serve, and strong financial reserves help ensure that they can meet this obligation even in times of operational disruption and financial distress.

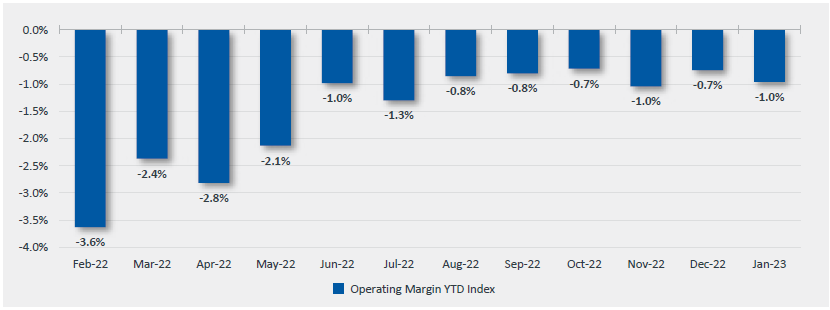

The importance of financial reserves was demonstrated over the course of 2022, when year-to-date median operating margins for not-for-profit hospitals and health systems remained in negative territory throughout the year (Figure 1). This means that more than half of the hospitals providing data for Kaufman Hall’s monthly National Hospital Flash Report ended the year with negative operating margins, and have not seen an improvement as they move into 2023. Net losses in 2022 for some of the nation’s largest not-for-profit health systems were well above $1 billion and in some cases approached $2 billion. These losses were driven by multiple factors, including ongoing operational disruptions related to the COVID-19 pandemic, staffing shortages that limited the ability to run operations at full capacity, rapidly escalating costs for supplies and—especially—labor (including the heightened use of expensive contract labor to help ease staffing shortages), and investment losses.

Figure 1: Kaufman Hall Operating Margin Index (Year-to-Date by Month), February 2022 –January 2023

Source: Kaufman Hall, National Hospital Flash Report, February 2023

With no immediate end in sight to the operational and financial pressures hospitals and health systems are facing, organizations will have to rely on their financial reserves to carry them through until conditions improve, or until organizations can adapt to a potential new reality of decreased revenue and increased expenses.

Not-for-profit hospitals and health systems have an obligation to their mission and the communities they serve, and strong financial reserves help ensure that they can meet this obligation even in times of operational disruption and financial distress.

This report looks, first, at the primary functions within the financial structure of not-for-profit hospitals and health systems and the role these functions play in generating financial reserves. It then looks at the significance of financial reserves in credit management efforts and in serving as a buffer in times of operational disruption or financial distress.

Key Findings from the Report

- With limited sources of funding, not-for-profit hospitals and health systems rely on financial reserves to withstand periods of operational disruption or financial distress and continue to provide services to their communities.

- Most not-for-profit organizations maintain financial reserves to make needed investments and pursue their mission in difficult times. In the closely related not-for-profit sector of higher education, for example, financial reserves often surpass those that are held by hospitals and health systems.

- Strong financial reserves help improve a hospital or health system’s credit rating, which assists with borrowing money for needed facility and technology investments at more affordable interest rates.

- Strong financial reserves can also increase the amount of money a hospital or health system can borrow, an important safety valve if the organization needs additional funds to buffer the impact of poor financial performance from disrupted operations or an economic downturn affecting returns on investments.

- When all else fails, not-for-profit hospitals and health systems can draw upon their financial reserves to cover their operating expenses until they are able to stabilize their operations, or until their reserves are depleted.

- The ultimate purpose of financial reserves is to ensure that resources are available when hospitals and health systems—and the communities they serve—need them the most.

- A very small percentage of not-for-profit hospitals and health systems can also generate meaningful funds through philanthropy, but most organizations do not have the capabilities for significant fundraising efforts.