Fact Sheet: AHA Urges Congress to Call on CMS to Stop Cuts to Hospitals

The Issue

America’s hospitals and health systems continue to face unprecedented financial pressures due to the ongoing effects of the COVID-19 pandemic and current inflationary economy. Historic inflation has extended and heightened the already severe economic instability brought on by the pandemic resulting in razor thin operating margins from massive surges in input costs, including a struggling workforce, drug costs, supplies and equipment. Even slight increases in expenses have had dramatic negative effects on many hospitals’ operating margins, jeopardizing their ability to care for patients and communities. Taken together, these shifts in the health care environment are putting enormous strain on hospitals and health systems, which will continue in FY 2023 and beyond.

environment are putting enormous strain on hospitals and health systems, which will continue in FY 2023 and beyond.

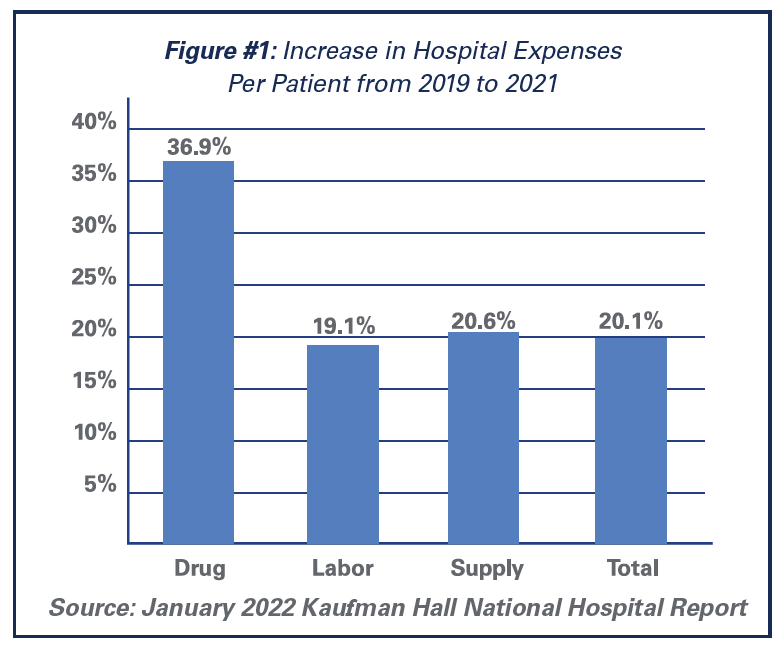

Even after accounting for changes in volume that occurred during the pandemic, hospital expenses per patient increased significantly from pre-pandemic levels. By the end of calendar year (CY) 2021, total hospital expenses per adjusted discharge were up 20.1% compared to pre-pandemic levels in 2019. Further exacerbating the problem for hospitals are Medicare sequestration cuts and payment rates that are well below cost increases. These levels of increased expenses and operating margin declines are not sustainable. Additional support and resources are needed to protect patients’ access to care.

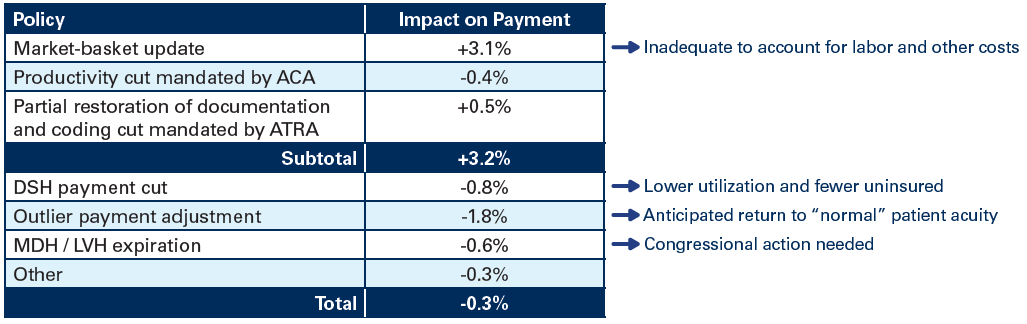

On top of these extraordinary challenges, hospitals and health systems are now facing additional, unnecessary financial pressures from the Centers for Medicare & Medicaid Services’ (CMS) proposed hospital inpatient prospective payment system (IPPS) proposed rule for fiscal year (FY) 2023. The rule’s proposed payment updates and policy changes would result in a net decrease in payments to IPPS hospitals in FY 2023 compared to FY 2022. CMS’ estimates were produced using historical data that in a steady-state economy may predict with some accuracy the anticipated rate of cost increases to determine provider reimbursements. The end of CY 2021 into CY 2022 should not, in any sense, be considered a steady-state economic environment representative of past trends. As a result, the proposed market basket and productivity update will inadequately reimburse hospitals and health systems.

AHA Take

Congress should urge CMS to use its “special exceptions and adjustments” authority to make a retrospective adjustment to account for the difference between the market basket update that was implemented for FY 2022 and the current projected FY 2022 market basket. In addition, Congress should urge CMS to eliminate the productivity cut for FY 2023.

Background

- CMS’ proposed market basket update of 3.2% for FY 2023, as well as the FY 2022 payment update of 2.7%, are woefully inadequate given the actual annual inflation rate is 8.6% for the 12 months ending in May 2022.

- Since the market basket and associated productivity update are forecasted using historical data, the current rising inflation and massive growth in expenses facing hospitals and health systems were not adequately considered in the estimates.

- Medicare only pays 84% of hospital costs on average according to our latest analyses.1 Inadequate payment updates that do not account for inflation will cause this underpayment to be even more egregious.

- Appropriately accounting for recent and future trends in inflationary pressures and cost increases in the hospital payment update is essential to ensure that Medicare payments for acute care services more accurately reflect the cost of providing hospital patient care.

- CMS itself has acknowledged that hospitals are unable to achieve productivity gains assumed by the general economy over the long run. Research indicates that hospitals can only achieve a productivity gain that is one-third of the gains seen in the private nonfarm business sector.2

See the AHA CMS IPPS proposed rule comment letter for impact details outlined in the chart above.

___________

1 American Hospital Association (February 2022). Underpayment by Medicare and Medicaid Fact Sheet. https://www.aha.org/system/files/media/file/2022/02/medicare-medicaid-underpayment-fact-sheet-current.pdf

2 Centers for Medicare & Medicaid Services. (February 2016). Hospital Multifactor Productivity: An Updated Presentation of Two Methodologies. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/ Downloads/ProductivityMemo2016.pdf