Telehealth Investment Shifts Signal Market Maturity

How long will telehealth continue to be the darling of investors and private-equity firms? That’s difficult to say, but a recent CB Insights report notes the sector is reaching a level of maturity.

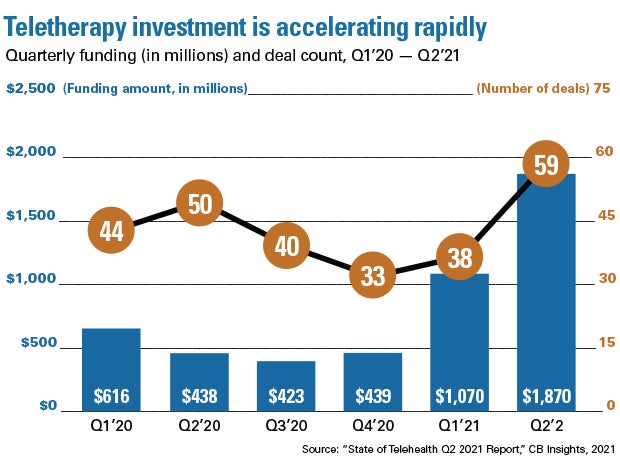

While global telehealth investments reached a record $5 billion in Q2 — a whopping 169% increase from Q2 2020 — there were some important shifts in where the money is going.

Investments in traditional telemedicine platforms declined, while virtual care, remote monitoring and telepharmacy received growing shares of capital. Nevertheless, providers are continuing to invest in telemedicine to be more responsive to patient needs and desires.

With telehealth visits stabilizing at roughly 10 times pre-pandemic levels, digital transformation initiatives are rising across the field. As a result of the pandemic, 60% of health care organizations are adding new digital projects, with telemedicine becoming a higher priority for 75% of executives (vs. 42% in 2019) to improve the patient experience.

Other highlights include:

- Teletherapy, coaching and care management segments accounted for nearly 40% of all deals in Q2.

- The top five Q2 teletherapy deals brought in $1.6 billion, with Noom’s behavioral health programs that combine remote care with human coaches, netting $540 million in Series F funding.

- The share of early-stage telehealth investment deals is tracking at a historical low while late-stage deals are at a high.

4 Acquisitions That Will Disrupt Virtual Care

- Walmart’s acquisition of virtual primary care provider MeMD is a move to compete with Amazon and its national rollout of virtual primary care services to employers. MeMD connects patients with licensed medical providers, psychiatrists and therapists.

- Care navigation company Accolade bought PlushCare for $450 million and will give Accolade users access to virtual primary care and mental health consultations.

- Insurer Bright HealthCare acquired virtual care enablement company Zipnosis. Bright HealthCare offers diversified health care products and managed care services to more than 500,000 consumers in 13 states.

- Cerebral, a telepsychiatry company that offers online provider visits, care counseling and prescription management services for those with anxiety and depression, received $162 million in Q2 funding and is now valued at $1.2 billion.