2 Ways Cash-Rich Digital Health Startups Will Reshape Care and Wellness

Digital health startups are on a roll in raising record levels of venture capital and their impact is growing on consumers, providers and the way care is delivered.

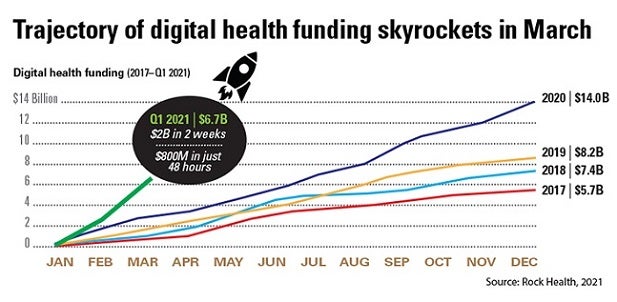

Last month alone saw about $4 billion in deals, capping a record-breaking Q1 total funding of $6.7 billion, notes Rock Health. That’s nearly half the $14 billion venture capital raised by digital health firms in all of 2020, which also was a record. And the percentage of overall venture capital dollars moving to digital health soared from 2% in 2011 to 9% in 2020.

But equally significant is what digital health companies are doing with this money. A look behind the investment numbers shows that companies focusing on primary care and behavioral health are key beneficiaries. What’s more, these digital health startups are using the funds to accelerate growth, forge new partnerships and, in many cases, take more health services directly to consumers.

But equally significant is what digital health companies are doing with this money. A look behind the investment numbers shows that companies focusing on primary care and behavioral health are key beneficiaries. What’s more, these digital health startups are using the funds to accelerate growth, forge new partnerships and, in many cases, take more health services directly to consumers.

The challenge for health care providers will be to keep up with this pace of innovation. They will need to balance the competing needs of retooling internal operations around existing technologies, while also embracing new digital transformation. Shifting from urgent telemedicine adoption to the next wave of virtual clinics and consumer-focused omnichannel approaches will require care model and business model redesign, supported by a favorable post-pandemic regulatory and payment landscape.

Offering On-demand, Affordable Primary Care

Direct-to-consumer virtual care and mail-order prescription startup Ro topped all Q1 megadeals at $500 million last month. Initially focused on men’s health and wellness issues, the company now valued at more than $5 billion steadily has expanded its services through a vertically integrated primary care platform, personalized end-to-end primary care from diagnosis to delivery of medication and ongoing care. The company will use its latest funding to expand its distribution pharmacy network, improve its proprietary electronic health record system, introduce remote patient monitoring with integrated devices and add other treatment areas to its service lines.

Hinge Health, which offers physical therapy virtually, landed $300 million in the third largest Q1 deal. The company sells in-home musculoskeletal therapy programs designed for individuals or enterprise purchase and provides one-on-one virtual coaching sessions with physical therapists or clinicians as needed. The company tripled its customer base and quadrupled its revenue last year and has become a preferred solution in CVS Health’s Point Solutions Management service to help its pharmacy benefits-management clients address a top medical cost driver.

Addressing Employer Demands for Virtual, Value-Based Behavioral Health

Among companies supporting a specific clinical condition, digital mental health companies generated the largest amount of Q1 funding, Rock Health notes. Megadeals of $100 million or more in funding went to Lyra Health ($187 million), BetterUp ($125 million) and Ginger ($100 million). The sector as a whole generated $2.4 billion in 2020 venture funding.

Lyra Health, now valued at about $2.3 billion, provides a digital behavioral health-benefits platform to increase access to care. The company will use its latest funding round to support growth and expand partnerships like the one it formed with ICAS World, an employee-assistance program provider.

BetterUp provides mental health fitness, on-demand support, parenting and nutrition specialists and other services through a network of 2,000-plus performance coaches, mentors and mental health counselors to employees of Hilton, Chevron and NASA. Valued at $1.73 billion, the company will use its latest round of funding to expand its products.

Ginger, now valued at more than $1.1 billion, rapidly is building partnerships with multinational employers and health plans. Last year, the company launched a value-based model that allows every eligible employee and adult dependent access to Ginger’s full spectrum of care for a fixed fee, including unlimited self-guided care, 24/7 on-demand behavioral health coaching and a predetermined number of therapy and psychiatry sessions. Its strategic partners include 30 integrated health systems and health plans.