Will You Be Ready for the Post-COVID-19 Financial World?

The ultimate financial impact of COVID-19 has yet to be determined, but health care leaders must start bracing now for some hard realities over the next couple of years.

Hospitals and health systems can expect sharp declines in commercially insured patients due to job losses in the pandemic economy, which likely will fuel a rise in Medicaid, exchange and uninsured patients. To a large extent, how effectively and aggressively provider organizations are able to manage in this new financial environment will determine their future success.

The good news is that many organizations already are responding, according to a recent survey conducted by the Healthcare Financial Management Association (HFMA), with companion analysis from the Guidehouse Center for Health Insights.

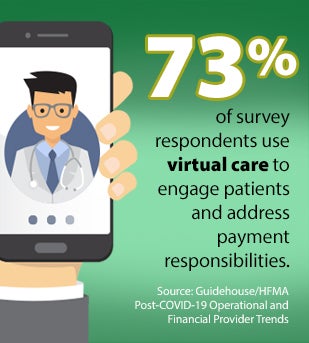

Here are some of the steps providers are taking to better manage patient payment issues. More than 90% of respondents report increasing their use of telehealth, which can improve care delivery efficiency and reduce costs for patients and providers with 73% using virtual care to engage patients and address payment responsibilities. Other strategies executives are employing include offering online portals for price estimates and payments (56%), and financial counseling and payment plans (63%).

Here are some of the steps providers are taking to better manage patient payment issues. More than 90% of respondents report increasing their use of telehealth, which can improve care delivery efficiency and reduce costs for patients and providers with 73% using virtual care to engage patients and address payment responsibilities. Other strategies executives are employing include offering online portals for price estimates and payments (56%), and financial counseling and payment plans (63%).

With the economy struggling to recover and unemployment remaining volatile as the obstinate pandemic persists, many insured patients will find it increasingly difficult to shoulder greater cost sharing through high-deductible plans, notes Timothy E. Kinney, Guidehouse partner. Kinney co-authored a recent HFMA report urging health care executives to reexamine their financial management strategies in light of looming market changes.

3 Financial Management Strategies to Explore

Dynamic Budgeting

The days of passive annual budgeting are over. Health care financial leaders will need to use rolling forecasts of revenue mix and growth and continuously track revenues by payer class and contract. This will become more important as employer-based insurance and public finance programs come under greater economic stresses.

Aggressive Cost Management

Reducing fixed costs and managing variable costs based on timely estimates of expected revenue are musts. Corporate overhead, vendor contracts and physician services contracts must be trimmed to reflect the reality of interrupted service volume and an uncertain recovery, the authors note. Variable expenses should be adjusted in real time to fit with actual realized revenues. These expenses include clinical and support staffing (environmental services, food service, etc.), supplies and pharmaceuticals. Converting fixed costs to variable as an operating philosophy will be a key element in the painful readjustment process that will be required in response to the COVID-19 crisis, the report states.

Telehealth and Telework

Telehealth volumes will have increased more than threefold in 2020 over 2019 levels, the survey found. This is expected to continue once COVID-19 subsides. As much as one-third to one-half of ambulatory visits could be virtualized, which would make it possible to reduce clinic space and staffing expenses. In addition, virtual work arrangements could grow incrementally as the pandemic winds down, with opportunities to reduce office space and fixed expenses. Furthermore, moving more in-person meetings to virtual conferencing can save executive time and potentially improve decision-making speed and operating efficiency.