Growing List of Competitors Targets Physician Practices

Hospitals and health systems have a growing list of competitors to concern themselves with as they navigate relationships with physician practices.

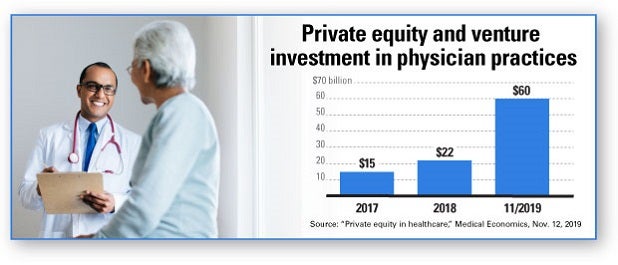

Nontraditional players, including private equity and venture capital firms, health plans and large employers increasingly are targeting physician practices for investment. Private equity investor deals in the U.S. related to physician practices in 2018 totaled $22 billion. By November 2019, that figure had surged to $60 billion and shows no sign of abating, Medical Economics reports.

This trend has left some hospitals and health systems feeling uncertain as their longtime partners draw investments from organizations that may have divergent interests.

A new AHA Center for Health Innovation Market Insights Report “Evolving Physician-Practice Ownership Models” explores the role of physicians at the center of the health care value equation, analyzes emerging investor types, strategic implications for hospitals and health systems and organizational threats and opportunities. In addition, several experts from firms that partner with hospitals and health systems and physician practices share their insights on what’s shaping trends in physician-practice ownership models.

UnitedHealth Group, Aetna, various Blue Cross Blue Shield entities and others now offer plans built around clinics the insurers or their affiliate companies own, featuring smaller networks with more limited choices of doctors and hospitals. This can reduce premiums, but insurers also benefit because they keep revenues inside their holdings. “Suddenly, the plan you’re relying on for payment is also competing with you at the front end of the delivery system,” Chas Roades, a health care consultant, recently told the Wall Street Journal.

Organizational Threats

While the impact of these trends will be highly market dependent, there are some significant business implications for hospitals and health systems to consider. Some include:

- Increased competition and cost for physician recruitment, which may hamper a health system’s ability to develop desired services along the care continuum.

- Physician groups owned by or aligned with insurer, private equity investors or venture capital groups may redirect patient care to those groups away from hospitals and health systems, including surgeries and inpatient admissions.

- Groups targeting special populations, special services, and subacute and urgent care may further fragment care and create a barrier to health system-driven integrated care models.

If investors are able to execute innovative new models of care, streamline operations and expand the continuum of physician practices, this also could create opportunities to partner or affiliate.

With this in mind, hospitals and health systems need to develop thoughtful and targeted physician alignment strategies based on organizational goals, available resources, practice management competencies and local market conditions. Regardless of the options for physician alignment, strong physician leadership and integration into practice governance models are key ingredients for success.

Organizational opportunities

For hospitals and health systems evaluating their strategies related to physician alignment, the report cites five organizational opportunities to consider, including:

- Explore clinical integration and affiliation models: Affiliating with well-run, established physician practices on clinical integration programs may yield better returns on investment than traditional employment models.

- Fill gaps in the care continuum: New practice models provide hospitals and health systems with access to a more robust continuum of care (telehealth, digital health services, specialty services, hospital-based physician services) that otherwise would be difficult to recruit and staff adequately.

- Divest costly management services organization functions: These opportunities allow the hospital to divest costly MSO functions while allowing the hospital to maintain affiliation with physicians.

New AHA resources to Set Physician Alignment Strategies

As companion pieces to the new “Evolving Physician-Practice Ownership Models” report, the AHA Center for Health Innovation has launched the following new resources:

- Physician Relationship Strategy: 18 Questions for Leadership Teams: Available exclusively to AHA members, this report will help hospital leaders as they review their strategies, consider their local market dynamics and strive to achieve clinical and financial objectives.

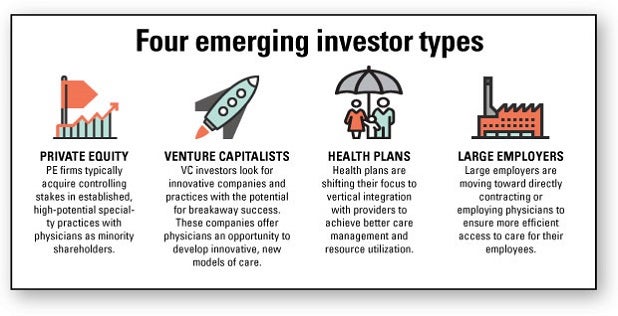

- New Investors in Physician-Practice Ownership Models: This report profiles four major new investor types: private equity, venture capitalists, health plans and large employers along with a representative sample of recent investments and partnerships.