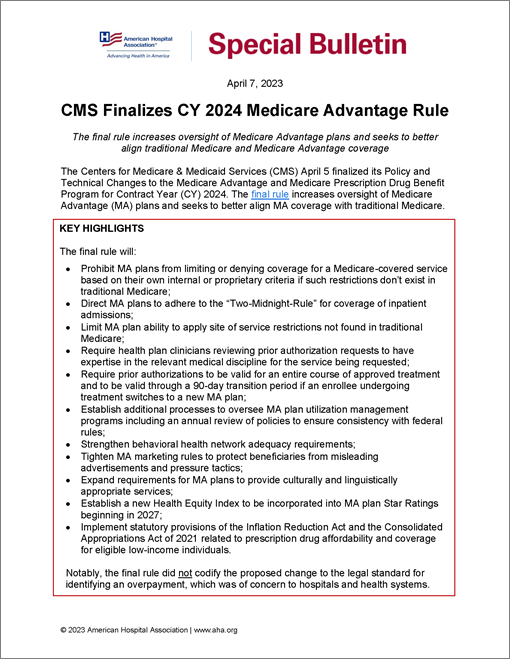

CMS Finalizes CY 2024 Medicare Advantage Rule

AHA Special Bulletin

April 7, 2023

The final rule increases oversight of Medicare Advantage plans and seeks to better align traditional Medicare and Medicare Advantage coverage

The Centers for Medicare & Medicaid Services (CMS) April 5 finalized its Policy and Technical Changes to the Medicare Advantage and Medicare Prescription Drug Benefit Program for Contract Year (CY) 2024. The final rule increases oversight of Medicare Advantage (MA) plans and seeks to better align MA coverage with traditional Medicare.

Key Highlights

The final rule will:

- Prohibit MA plans from limiting or denying coverage for a Medicare-covered service based on their own internal or proprietary criteria if such restrictions don’t exist in traditional Medicare;

- Direct MA plans to adhere to the “Two-Midnight-Rule” for coverage of inpatient admissions;

- Limit MA plan ability to apply site of service restrictions not found in traditional Medicare; Require health plan clinicians reviewing prior authorization requests to have expertise in the relevant medical discipline for the service being requested;

- Require prior authorizations to be valid for an entire course of approved treatment and to be valid through a 90-day transition period if an enrollee undergoing treatment switches to a new MA plan;

- Establish additional processes to oversee MA plan utilization management programs including an annual review of policies to ensure consistency with federal rules;

- Strengthen behavioral health network adequacy requirements;

- Tighten MA marketing rules to protect beneficiaries from misleading advertisements and pressure tactics;

- Expand requirements for MA plans to provide culturally and linguistically appropriate services;

- Establish a new Health Equity Index to be incorporated into MA plan Star Ratings beginning in 2027;

- Implement statutory provisions of the Inflation Reduction Act and the Consolidated Appropriations Act of 2021 related to prescription drug affordability and coverage for eligible low-income individuals.

Notably, the final rule did not codify the proposed change to the legal standard for identifying an overpayment, which was of concern to hospitals and health systems.

AHA TAKE

The AHA is increasingly concerned about certain MA plan policies that restrict or delay patient access to care, which also add cost and burden to the health care system. These concerns were validated by a report issued by the Office of Inspector General (OIG) last year showing that some MA plans have exhibited a pattern of denying prior authorization and payment requests that would have been covered under traditional Medicare. These findings, and the broader experience of hospitals and health systems, reflects that certain commercial insurer policies can be harmful to patients and the providers who care for them. Accordingly, the AHA supports policies designed to increase health plan accountability and strengthen consumer protection, including the broad array of policies finalized in this rule that will improve the way Medicare coverage works for beneficiaries and their providers.

In a statement shared with the media on April 5, Ashley Thompson, AHA senior vice president of public policy analysis and development, said, “The AHA commends CMS for finalizing critical policies that will help ensure beneficiaries enrolled in Medicare Advantage have access to the medically necessary health care services to which they are entitled. In addition, we appreciate the agency’s increased attention to oversight of Medicare Advantage plans. Hospitals and health systems have raised the alarm that beneficiaries enrolled in some Medicare Advantage plans are routinely experiencing inappropriate delays and denials for coverage of medically necessary care. This rule will go a long way in protecting patients and ensuring timely access to care, as well as reducing inappropriate administrative burden on an already strained health care workforce.

“The final rule includes helpful provisions to ensure more consistency between Medicare Advantage and traditional Medicare by curtailing overly restrictive coverage policies that can impede access to care and add cost and burden to the health care system. We also applaud CMS’ attention to addressing access gaps in behavioral health and post-acute care services where our members commonly report some of the most significant insurance-related barriers to patient care.

“The AHA will continue to carefully review the final rule and urges the agency to conduct rigorous oversight and enforcement to ensure meaningful compliance.”

For additional detail, the CMS Fact Sheet on the final rule summarizes key provisions.

HIGHLIGHTS OF THE FINAL RULE

Prior Authorization and Medical Necessity Determinations

CMS finalized several updates designed to curtail improper MA plan prior authorization processes and ensure MA beneficiaries receive timely and appropriate access to medically necessary care. Specifically, the agency stipulates that MA plans may only utilize prior authorization processes to confirm whether a patient’s care is medically necessary, addressing concerns that plans were creating non-clinical barriers to care in their programs.

Additionally, the final rule requires that MA plans adhere to traditional Medicare coverage policies when making a medical necessity determination and cannot utilize alternative criteria to deny coverage of an item or service that would be approved under CMS rules. In response to hospital and health system advocacy, the final rule also explicitly clarifies that MA plans must adhere to the “Two-Midnight Rule” under traditional Medicare, which requires that an MA plan provide coverage for an inpatient admission when the admitting physician expects the patient to require hospital care that crosses two-midnights.

The rule provides specific examples in the arena of post-acute care, which the OIG report identified as a service category with frequent rates of inappropriate denials, citing that MA plans cannot, for example, deny coverage or redirect to a lower level of care unless the patient explicitly does not meet the Medicare coverage criteria required for the recommended level of care. The rule also finalizes policies that limit MA plan ability to establish site of service restrictions if such limitations do not exist in traditional Medicare.

If a service does not have established coverage criteria under traditional Medicare rules, plans may adopt criteria based on widely used treatment guidelines or clinical literature only if the plan creates a publicly accessible summary of the evidence, a list of the sources, and an explanation of the rationale for the internal coverage criteria.

Additionally, CMS finalized regulatory language stipulating that if an MA plan approved a covered item or service through a prior authorization or pre-service determination of coverage or payment, it may not deny coverage later on the basis of lack of medical necessity or reopen such a decision unless there is good cause or evidence of fraud.

To promote clinical validity, CMS codified that a physician or other appropriate health care professional reviewing a request for prior authorization or a coverage denial must have expertise in the field of medicine related to the service being requested. Additionally, to ensure that plan policies are adequately reviewed and currently appropriate, the rule requires plans to establish a Utilization Management Committee led by the plan’s medical director. This committee will be required to conduct an annual review of plan prior authorization and other utilization management polices to ensure compliance with Medicare rules and consistency with current clinical guidelines.

Furthermore, the final rule requires prior authorizations to be valid for the entirety of an approved course of treatment. This prevents plans from approving a reduced number of days of prescribed treatments or requiring additional prior authorizations for each treatment in a series prescribed by a provider. Plans also must have policies that permit no less than 90 days transition for new beneficiaries on established treatments prior to enrolling with the plan.

Behavioral Health Access

CMS finalized several provisions that establish standards for access to behavioral health services under MA. Currently, MA plans are required to provide access to an adequate network of “appropriate providers,” including primary care providers, specialists, hospitalists and others; this rule explicitly adds providers that specialize in behavioral health services to this list. Plans also are required to demonstrate that the network includes an adequate supply of psychiatrists and inpatient psychiatric facilities for the population served. This rule further requires plans to include an adequate supply of clinical psychologists, licensed clinical social workers and prescribers of medication for opioid use disorder in their networks subject to time, distance, and minimum provider standards in network adequacy reviews. CMS also codified minimum access wait time standards (e.g., number of days to appointment) for primary care and behavioral health services. Additionally, CMS finalized changes to add behavioral health services to the types of services for which MA plans must have programs in place to ensure continuity of care and integration of services.

Finally, the agency definitively clarified that an emergency medical condition can be physical or mental. This language requires MA organizations to ensure that MA enrollees receive medically necessary behavioral health services in a medical emergency, which would not be subject to prior authorization.

MA Star Ratings

CMS finalized a number of substantive changes to the Star Ratings program for MA and Part D plans. To encourage health plans to improve performance for patients with certain social risk factors, CMS will replace its current reward factor for consistently high star ratings performance with a new health equity index (HEI) reward beginning in the 2024 and 2025 measurement periods for inclusion in the 2027 Star Ratings.

CMS also finalized changes to:

- Reduce the weight of patient experience/complaints and access measures;

- Remove certain types of Star Ratings in the future; and

- Remove the 60 percent rule that is part of the adjustment for extreme and uncontrollable circumstances.

Advancing Health Equity

CMS finalized clarifications and expansions of several existing MA regulations intended to advance health equity for all enrollees. Specifically, CMS expanded the list of populations to which plans are expected to provide culturally competent services. The final rule also requires that enrollees with low digital health literacy are identified and offered digital health education to improve access to medically necessary covered telehealth benefits. In addition, the final rule requires plans to include additional provider details in their provider directories, including cultural/linguistic capabilities, accessibility for people with physical disabilities, and whether the provider can provide medications opioid use disorders. Finally, the rule requires plans to incorporate one or more activities in their quality improvement programs targeted at reducing disparities in health and health care among their enrollees.

Restricting Marketing

The final rule contains a variety of provisions designed to restrict MA plan marketing practices that may be misleading to consumers, increase oversight of third-party marketing agents used by MA plans, and prohibit pressure tactics designed to facilitate enrollment. Specifically, the final rule prohibits advertisements for MA plans that do not mention a specific plan name, as well as those that use words or imagery (for example the Medicare name or logo) intended to mislead or confuse potential beneficiaries, such as trying to make it appear the information is from a government agency. The final rule also bans sales presentations immediately following educational events and further restrict other sales interactions that may involve pressuring consumers while presenting only a subset of plan options. In addition, the rule requires sales agents to disclose to prospective beneficiaries information about all the plans the agent sells; describe information that can be obtained from Medicare.gov; and review a standardized list of questions and pre-enrollment checklist with any prospective beneficiary. Agents will be required to explain the effects of a prospective beneficiary’s enrollment choices on their coverage.

Implementing Statutory Provisions

The final rule implements provisions of the Consolidated Appropriations Act of 2021 and the Inflation Reduction Act by expanding access to low-income subsidies available under Part D and making permanent the limited income newly eligible transition (LINET) program. The LINET currently operates as a demonstration program providing immediate and retroactive Part D coverage for certain low-income beneficiaries who do not yet have prescription drug coverage.

FURTHER QUESTIONS

If you have further questions, please contact Michelle Millerick, AHA’s senior associate director of health insurance & coverage policy, at mmillerick@aha.org, or Terry Cunningham, AHA’s director of administrative simplification policy, at tcunningham@aha.org.