AHA Summary of Hospital Inpatient PPS Proposed Rule for Fiscal Year 2023

Special Bulletin

April 19, 2022

The Centers for Medicare & Medicaid Services (CMS) April 18 issued its hospital inpatient prospective payment system (PPS) and long-term care hospital (LTCH) PPS proposed rule for fiscal year (FY) 2023. The rule proposes a 3.2% rate increase for inpatient PPS payments in FY 2023. However, when accounting for proposed changes to disproportionate share hospital (DSH) payments, outlier payments, the Medicare-dependent hospital (MDH) and low-volume adjustment (LVA) programs, and other policies, CMS estimates that inpatient PPS hospitals would actually see a net decrease of 0.3% from FY 2022 to FY 2023. Highlights of the proposals related to the LTCH PPS are covered in a separate Special Bulletin.

Key Highlights

CMS’ proposed policies would:

- Increase inpatient PPS payment rates by 3.2% in FY 2023.

- Use FY 2018 and 2019 Worksheet S-10 data to determine the distribution of FY 2023 DSH uncompensated care payments. CMS also would use a three-year average of S-10 data for FY 2024 and beyond.

- Cut DSH payments by about $800 million, due partially to a decrease in the uninsured population.

- Decrease outlier payments by 1.8 percentage points. CMS states this is necessary to return to the target of paying 5.1% of inpatient PPS funds as outlier payments.

- End the Medicare-dependent hospital and low-volume adjustment programs, which expire on Sept. 30, 2022 under the law.

- Permanently apply a 5% cap on any decrease in a hospital’s area wage index. Implement changes to the graduate medical education (GME) program, related to the calculation of full-time equivalent (FTE) caps.

- Apply measure suppressions to the Hospital Acquired-Condition (HAC) Reduction Program and most measures in the Hospital Value-based Purchasing (HVBP) program, resulting in neutral payment adjustments for FY 2023.

- Add 10 new measures to the inpatient quality reporting (IQR) program.

- Propose several policies intended to advance health equity.

- Seek several requests for information on measurement policy topics, maternal health, climate change and health equity, and payment adjustments for N95 respirators.

AHA TAKE

We are extremely concerned with CMS’ proposed payment update of only 3.2%, given the extraordinary inflationary environment and continued labor and supply cost pressures hospitals and health systems face. Even worse, hospitals would actually see a net decrease in payments from 2022 to 2023 under this proposal because of proposed cuts to DSH and other payments. This is simply unacceptable for hospitals and health systems, and their caregivers, that have been on the front lines of the COVID-19 pandemic for over two years now. While we have made great progress in the fight against this virus, our members continue to face a range of challenges that threaten their ability to continue caring for patients and providing essential services for their communities. See AHA’s full statement that was shared with the media here.

Highlights of the inpatient PPS rule follow.

FY 2023 IPPS PROPOSED CHANGES

Inpatient PPS Payment Update

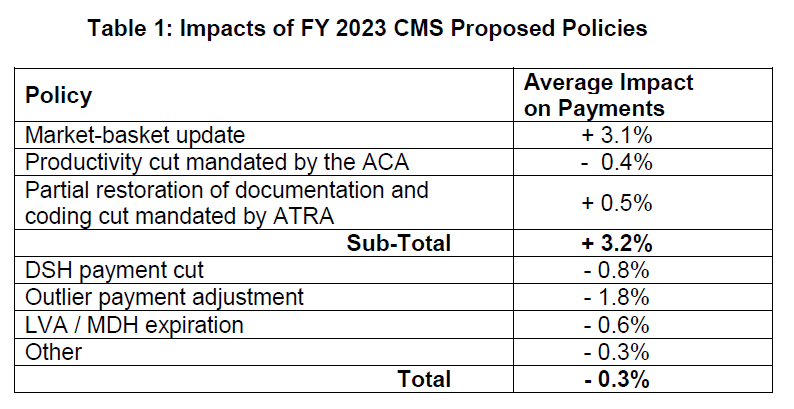

The proposed rule would increase inpatient PPS rates by a net of 3.2% in FY 2023, compared to FY 2022, after accounting for inflation and other adjustments required by law. Specifically, the update includes an initial market-basket update of 3.1%, less 0.4 percentage points for productivity required by the Affordable Care Act (ACA), and plus 0.5 percentage points to partially restore cuts made as a result of the American Taxpayer Relief Act (ATRA) of 2012.

The ACA and ATRA adjustments would be applied to all hospitals. Additionally, hospitals not submitting quality data would be subject to a one-quarter reduction of the initial market basket and, thus, would receive an update of 2.43%. Hospitals that were not meaningful users of electronic health records (EHRs) in FY 2020 would be subject to a three-quarter reduction of the initial market basket and, thus, would receive an update of 0.88%. Hospitals that fail to meet both of these requirements would be subject to a market-basket update of 0.10%.

The proposed increase in payment rates is offset by a 1.8 percentage point decrease in outlier payments, as well as other proposed policies and program expirations (e.g. DSH, LVA, MDH) resulting in a net decrease of $0.3 billion in FY 2023 compared to FY 2022.

Table 1 below details the impact of proposed policies.

To approximate expected FY 2022 inpatient hospital utilization for rate-setting purposes, CMS proposes to use FY 2021 MedPAR claims and FY 2020 cost report data, as it ordinarily would have done. However, to account for the potential impact of COVID-19 on hospitalizations, CMS proposes several modifications to its calculations of MS-DRG relative weights and outlier fixed-loss amount.

Disproportionate Share Hospital (DSH) Payment Changes

Under the DSH program, hospitals receive 25% of the Medicare DSH funds they would have received under the former statutory formula (described as “empirically justified” DSH payments). For FY 2023, CMS estimates the empirically justified DSH payments to be $3.32 billion. The remaining 75% flows into a separate funding pool for DSH hospitals. This pool is updated as the percentage of uninsured individuals changes and is distributed based on the proportion of total uncompensated care each Medicare DSH hospital provides. For FY 2023, CMS estimates the 75% pool to be approximately $9.95 billion. After adjusting this pool for the percent of individuals without insurance, CMS estimates the uncompensated care amount to be approximately $6.54 billion. Total DSH payments are expected to decline by roughly $834 million compared to FY 2022.

The agency proposes to use the two most recent years of audited data from Worksheet S-10 to determine the distribution of DSH uncompensated care payments for FY 2023. Specifically, CMS proposes using S-10 data from FY 2018 and 2019 cost reports. Additionally, for FY 2024 and beyond, CMS proposes to use a three-year average of the three most recent fiscal years for which audited data is available.

In addition, beginning in FY 2023, CMS proposes to discontinue the use of low-income insured days as a proxy for uncompensated care for Indian Health Service and Tribal hospitals and establish a new supplemental payment.

Finally, CMS proposes to revise the regulations related to the calculation of the Medicaid fraction of the Medicare DSH calculation. Specifically, CMS proposes to define “regarded as eligible” for Medicaid to include only patients who receive health insurance authorized by a section 1115 demonstration or patients who pay for all or substantially all of the cost of such health insurance with premium assistance authorized by a section 1115 demonstration where state expenditures are matched with federal Medicaid funds.

Area Wage Index

CMS makes several proposals in the rule around the area wage index, which adjusts payments to reflect differences in labor costs across geographic areas. First, the agency proposes to continue its low-wage-index hospital policy as established in the FY 2020 final rule. Specifically, for hospitals with a wage index value below the 25th percentile, the agency would continue to increase the hospital’s wage index by half the difference between the otherwise applicable wage index value for that hospital and the 25th percentile wage index value for all hospitals. As it has done previously, the agency would reduce the FY 2023 standardized amount for all hospitals to make this policy budget neutral.

Second, to prevent large year-to-year variations in the wage index, CMS proposes to permanently apply a 5% cap on any decrease to a hospital’s wage index from the prior fiscal year. This would be applied in a budget-neutral manner.

Medicare Graduate Medical Education

Due to a court ruling related to the agency’s method of calculating direct GME payments to teaching hospitals when the weighted full-time equivalent (FTE) counts exceed the cap, CMS proposes to modify its policy related to FTE caps. Specifically, the proposed policy would address situations for applying the FTE cap when a hospital’s weighted FTE count is greater than its FTE cap, but would not reduce the weighting factor of residents that are beyond their initial residency period to an amount less than 0.5.

CMS also proposes to allow an urban and a rural hospital participating in the same Rural Training Program (RTP) to enter into a RTP Medicare GME affiliation agreement, which would allow some flexibility to teaching hospitals that cross-train residents.

Medicare-dependent Hospital and Low-volume Adjustment Programs

Under statute, the low-volume hospital policy is set to revert to requirements that were in effect prior to FY 2011. Therefore, beginning in FY 2023, CMS proposes to revert and modify the definition of a low-volume hospital and the methodology for calculating the payment adjustment to statutory requirements. Additionally, the MDH program is set to expire at the end of FY 2022. As such, absent congressional action, hospitals that previously qualified for the MDH status will no longer have MDH status and will be paid based on IPPS federal rates beginning in FY 2023. The AHA is strongly advocating to make the enhanced low-volume policy and MDH program permanent.

Complication/Comorbidity and Major Complication/Comorbidity Analysis

In the FY 2022 IPPS proposed rule, CMS solicited comments on adopting a change to the severity level designation of the 3,490 “unspecified” diagnosis codes currently designated as either complication/comorbidity (CC) or major complication/comorbidity (MCC), where there are other codes available in that code subcategory that further specify the anatomic site, to a Non-CC for FY 2022. If approved, the change would have affected the severity level assignment for 4.8% of the ICD-10-CM diagnosis codes. Instead, for FY 2022 CMS finalized effective beginning with discharges on or after April 1, 2022, a new Medicare Code Editor (MCE) code edit for “unspecified” codes, to provide additional time for providers to be educated while not affecting the payment the provider is eligible to receive. For FY 2023, CMS is not proposing to change the designation of any ICD-10-CM diagnosis codes, including the unspecified codes that are subject to the “Unspecified Code” edit, as CMS continues its comprehensive CC/MCC analysis to allow stakeholders the time needed to become acclimated to the new edit.

Promoting Interoperability Program

CMS proposes a number of significant changes to the objectives and measures of the Promoting Interoperability Program starting with the calendar year (CY) 2023 reporting period:

- Increase the points associated with the Electronic Prescribing objective from 10 to 20 points, and make mandatory the query of prescription drug monitoring program measure, and expand it to include schedule II, III and IV drugs;

- Increase the points associated with the Public Health and Clinical Data Exchange objective from 10 to 25 points, and add a new required antimicrobial use and resistance surveillance measure;

- Reduce the points associated with the Health Information Exchange objective from 40 to 30 points, and add an optional attestation measure reflecting whether hospitals enable exchange under the Trusted Exchange Framework and Common Agreement (TEFCA);

- Reduce the points associated with the Provide Patients with Electronic Access to their Health Information from 40 to 25 points; and

- Adopt the same changes to the Promoting Interoperability Program’s electronic clinical quality measures (eCQM) measure set and required reporting proposed for the IQR program.

Hospital Quality Reporting and Value Programs

CMS proposes several significant policy changes intended to account for the impact of the COVID-19 PHE on its hospital quality reporting and value programs. The agency also proposes to add 10 new measures to the inpatient quality reporting (IQR) program, and to adopt several policies intended to advance health equity.

- Hospital Acquired-Condition (HAC) Reduction Program. In last year’s inpatient PPS final rule, CMS adopted a COVID-19 measure suppression policy that permits the agency to not use quality measure data the agency believes have been distorted by the pandemic. Using this policy, CMS proposes to suppress all six measures in the HAC Reduction Program for FY 2023. As a result, no hospitals would be penalized under the HAC Reduction Program for FY 2023. However, CMS would continue to publicly report on hospital performance on the program’s healthcare associated infection (HAI) measures. CMS also proposes to suppress the program’s HAI measures for FY 2024, but would retain the claims-based Patient Safety Indicator (PSI) measure with technical changes intended to risk-adjust for COVID-19 diagnoses.

- Hospital Value-based Purchasing (HVBP) Program. As it did for FY 2022, CMS proposes to suppress most of the HVBP program’s measures for FY 2023, including the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) measures and five health care associated infection measures. As a result, CMS again believes it cannot calculate fair scores for hospitals nationally, and proposes that all hospitals would receive neutral payment adjustments under the VBP for FY 2023. Similar to last year, CMS also proposes to calculate and report HVBP measure scores publicly where feasible and appropriate.

- Hospital Readmissions Reduction Program (HRRP). For the FY 2024 HRRP, CMS proposes to resume scoring hospitals on the pneumonia readmissions measure that it suppressed for FY 2023. CMS would add the same COVID-19 diagnosis exclusion to the pneumonia measure that it adopted for the other five measures in the program. In addition, for all six measures in the HRRP, CMS proposes to include patient history of COVID-19 in the 12 months prior to the index hospitalization as a co-variate in the measures’ risk adjustment models.

- Inpatient Quality Reporting (IQR). CMS proposes to add 10 new measures to the IQR program. The measures and the period in which data collection and reporting would begin are listed below:

- Hospital Commitment to Health Equity, a measure asking hospitals to attest to whether they are implementing certain health equity-related practices (CY 2023);

- Two “Social Drivers of Health” measures reflecting whether hospitals screen admitted patients for food insecurity, housing instability, transportation problems, utility needs and interpersonal safety (optional for CY 2023, required starting in CY 2024);

- Two perinatal care eCQMs reflecting the rates of Cesarean Births (CY 2023) and Severe Obstetric Complications (CY 2024)

- Two other eCQMs reflecting hospital performance on opioid-related adverse events and malnutrition (CY 2024) ;

- A patient-reported outcome performance measure (PRO-PM) reflecting functional recovery among elective total hip and knee replacement patients (optional July 1, 2023 – June 30, 2024, required July 1, 2024 – June 30, 2025);

- Updated versions of the Medicare Spending per Beneficiary and hip/knee complication measures currently used in the hospital VBP program (claims-based, starting with FY 2024 program years)

CMS also proposes refinements to its elective hip/knee replacement payment measure, and its excess days in acute care following acute myocardial infarction measure.

Lastly, CMS proposes to increase the number of eCQMs required for reporting from four to six measures starting with the CY 2024 reporting period, which would affect payment in FY 2026. Hospitals would be required to report the proposed perinatal, and the previously adopted Safe Use of Opioids eCQM, while self-selecting three other eCQMs.

- Requests for Information. The proposed rule includes several RFIs on several key measurement policy related topics -- guiding principles for health disparities measurement; approaches to advancing digital quality measurement; and how to use its policies and programs to address maternal health, including both quality measures and Medicare Conditions of Participation (CoPs).

- Proposed Maternal Quality Designation and Maternal Health RFI. In conjunction with Vice President Harris’s Maternal Health Day of Action announcement in late 2021, CMS proposes to establish a publicly reported designation indicating hospital quality and safety for maternity care. Beginning in the fall of 2023, CMS would award this designation to hospitals that attest positively to both questions in the IQR’s previously adopted Maternal Morbidity Structural Measure. This measure asks whether a hospital (1) is currently participating in a structured state or national Perinatal Quality Improvement Collaborative and (2) implementing patient safety practices or bundles as part of these initiatives. CMS notes that it intends to propose in future rulemaking a more robust set of criteria for this designation, including other maternal health-related measures that may be finalized in the IQR program (such as the two proposed for adoption in this proposed rule).

Hospital Infectious Disease Data Reporting CoP for COVID-19 and Future PHEs

In 2020, CMS adopted a CoP requiring hospitals and critical access hospitals (CAHs) to submit certain data related to COVID-19 and other acute respiratory illnesses (i.e., influenza) to the Department of Health and Human Services (HHS). While the CoP was written to expire at the conclusion of the COVID-19 public health emergency (PHE), CMS suggests its need to monitor the impact of the pandemic could extend beyond the current PHE. In addition, the agency states that it and its federal partner agencies want a more permanent policy allowing it to collect data in the event of future PHEs involving infectious diseases.

As a result, CMS proposes to revise the COVID-19 hospital data reporting CoP it adopted in 2020 so that hospital COVID-19-related reporting would continue after the conclusion of the current PHE through April 30, 2024, unless the HHS Secretary establishes an earlier end date. The broad data reporting categories proposed in the rule align with current reporting requirements. In addition, CMS proposes to establish a new CoP for future PHEs that would require hospitals and CAHs to report certain data to the Centers for Disease Control and Prevention in the event of a PHE declaration for an infectious disease.

Request for Information: Climate Change and Health Equity

As a byproduct of Executive Order 14008 on Tackling the Climate Crisis at Home and Abroad, the proposed rule includes a request for information (RFI) on how hospitals and other health care providers can better prepare for the impact of climate change on beneficiaries and consumers and how CMS can best support that work. The RFI specifically seeks comments on what HHS and CMS can do to help hospitals determine the impacts of climate change on their patients. Further, the agency seeks comment on how it can help providers better understand the threats of climate change on their health care operations, as well as what steps they can take to reduce emissions and track their progress.

Request for Information: Payment Adjustments for N95 Respirators

As a result of Executive Order 13987, “Organizing and Mobilizing the United States Government To Provide a Unified and Effective Response To Combat COVID–19 and To Provide United States Leadership on Global Health and Security,” CMS is seeking comments and feedback on the appropriateness of a payment adjustment to recognize the additional resource costs associated with acquiring NIOSH-approved surgical N95 respirators that are wholly domestically made. The agency is considering the payment adjustment for FY 2023 and beyond.

FURTHER QUESTIONS

CMS will accept comments on the IPPS proposed rule through June 17. The final rule will be published around Aug. 1, and the policies and payment rates will take effect Oct. 1. Watch for a more detailed analysis of the proposed rule in the coming weeks.

If you have further questions, contact Shannon Wu, AHA senior associate director of policy, at 202-626-2963 or swu@aha.org.