AHA Comments to CMS on Review Choice Demonstration for Inpatient Rehabilitation Facilities

October 8, 2021

The Honorable Chiquita Brooks-LaSure

Administrator

Centers for Medicare & Medicaid Services

Attention: Office of Strategic Operations and Regulatory Affairs

7500 Security Boulevard, Room C4–26–05

Baltimore, MD 21244–1850

RE CMS – 10765: Medicare Program. CMS 10765; Review Choice Demonstration for Inpatient Rehabilitation Facilities (IRF) Services: Information Collection Activities: Submission for OMB Review.

Dear Ms. Brooks-LaSure:

On behalf of our nearly 5,000 member hospitals, health systems and other health care organizations; our clinician partners — including approximately 875 inpatient rehabilitation facilities (IRFs), more than 270,000 affiliated physicians, 2 million nurses and other caregivers; and the 43,000 health care leaders who belong to our professional membership groups, the American Hospital Association (AHA) appreciates the opportunity to respond to the agency’s most recent information collection notice proposing an IRF review choice demonstration (RCD). We once more ask the Centers for Medicare & Medicaid Services (CMS) to withdraw this proposed demonstration, which would implement new program integrity audits for all IRFs in four states. Our main concern is the timing of these new audits, which would begin during the ongoing COVID-19 public health emergency (PHE) and thus would divert critical resources from the IRF field’s efforts to help fight the pandemic. Additionally, we continue to have numerous operational and design concerns about the RCD, which are described in detail below.

Under the proposed IRF RCD, Medicare fee for service (FFS) claims for all admissions to IRFs in four target states — Alabama, California, Pennsylvania and Texas — would be subject to either pre-claim or post-payment review. The specified purpose of this five-year demonstration, which is likely to begin in 2022, is to “improve methods for the identification, investigation, and prosecution of potential Medicare fraud.” The demonstration would assess compliance with coverage and documentation standards. Auditors would review 100% of an IRF’s claims. IRFs with an approval rate of at least 90% would continue to undergo spot checks of a small sample of claims.

In addition to the timing concerns mentioned above, we continue to have additional concerns with the proposal. Specifically, it would:

- Perpetuate the long-standing issue of Medicare auditors lacking adequate knowledge of IRF-specific coverage and payment guidelines.

- Materially and needlessly increase administrative burden for IRFs in the target states.

- Place an unwarranted burden on IRFs with no history of noncompliance.

NEW DEMONSTRATIONS SHOULD NOT BE INITIATED DURING THE PHE

The AHA continues to have serious concerns about the timing of this demonstration, given both the duration of the pandemic and the number of intense surges the country has experienced. Throughout the pandemic, IRFs have continued to treat patients with and recovering from COVID-19, as well as those transferred from overwhelmed general acute-care hospitals. These pandemic-driven admissions often include “long-haul” COVID patients who, as a result of the virus, face a longer-term and often complex recovery trajectory requiring specialized care to address pulmonary and other complexities and debilities. Furthermore, at this point, we are confident that the pandemic will continue into 2022. Specifically, the hospital field writ large is very concerned about a forthcoming winter surge, due to persistently low vaccination rates in certain parts of the country and cold temperatures, which are expected to increase COVID-19 rates due to increased indoor interaction.

The PHE waivers for IRFs have increased the flexibility to collaborate with general acute-care hospital partners, including IRF units that were, in whole or in part, repurposed to accommodate patients that exceeded the host hospital’s capacity. Given the continuing emergence of COVID-19 hotspots, the varying resources across communities, and the complex needs of some COVID-19 patients, these waivers remain instrumental in enabling IRFs to help fight against the virus.

However, despite the waivers, IRFs located in hotspots are still experiencing numerous and unprecedented operational challenges, such as shifts in case-mix, inadequate testing supplies and personal protective equipment, fill-in personnel for infected staff, and, more recently, unsteady vaccine supply and distribution planning. COVID-19 demands such as these, which are currently straining the entire health care system, were neither discussed nor addressed at all in the IRF RCD notice.

DEMONSTRATION PERPETUATES LONG HISTORY OF INADEQUATE AUDITOR TRAINING AND KNOWLEDGE

Prior IRF audits, including those conducted by the Department of Health and Human Services Office of the Inspector General (OIG), recovery audit contractors (RAC) and Certified Error Rate Testing (CERT) auditors, used nurse auditors to review claims for compliance with Medicare coverage and documentation requirements.

Unfortunately, these audits had a track record of consistently inaccurate determinations and other problems. Yet, despite this history, the IRF RCD proposes to follow the same pattern of relying on nurses who may lack adequate knowledge of relevant IRF statutory, regulatory and sub-regulatory requirements, as well as related clinical matters. This use of auditors that lack validated IRF policy knowledge will likely lead to audit results that have a high error rate — a situation that is troubling and inappropriate.

The AHA remains concerned that, based on past practices, IRF RCD auditors will second-guess the medical necessity determination of rehabilitation physicians who not only examine and communicate with the patient in person, but also have experience and specialized expertise in medical rehabilitation. IRFs treat medically complex patients requiring both hospital care and intense rehabilitation, including patients with traumatic spinal cord injuries, stroke, neurological impairment, hip fracture and traumatic brain injury. For patients such as these, IRFs specialize in restoring the level of health and functionality to the level needed to regain independence. In the FY 2021 IRF PPS final rule, CMS itself recognized the “extensive training and knowledge that rehabilitation physicians bring to the care of IRF patients” and the “central role” that their expert judgment plays in executing a patient’s plan of care. In fact, that rule preserved the requirements for key rehabilitation physician duties, including to validate whether a pre-admission screening warrants an IRF admission, establish the overall plan of care and lead weekly interdisciplinary team conferences, which include rehabilitation nurses, social workers or case managers, and treating therapists carrying out the patient’s care plan. We also note that a patient’s eligibility for an IRF admission is ultimately based solely on a rehabilitation physician’s medical assessment and determination of clinical need relative to substantial Medicare coverage and payment criteria.

If CMS does proceed with this demonstration, it should require every potential IRF auditor to demonstrate that they possess comprehensive knowledge of relevant IRF coverage and other key policies in the statute, as well as Medicare regulations and sub-regulatory guidance. Given these auditors’ ability to second-guess and overturn the medical opinion of the treating physician, we believe this is a reasonable requirement. Further, we urge CMS to require that rehabilitation physicians with credentials consistent with those for physicians practicing in an IRF provide ongoing oversight of IRF auditors.

DEMONSTRATION WOULD PERPETUATE SYSTEMIC PROBLEMS WITH IRF AUDITS

The history of Medicare audits of IRFs, a sample of which is highlighted below, includes an egregious number of examples of inadequate audit policy safeguards, which demonstrate the difficulty in accurately auditing IRF cases. Unfortunately, this proposed demonstration would perpetuate these problems, which is inappropriate given the needless and costly administrative burden it would place on providers, a particular problem during the PHE. Furthermore, any audits and reviews for services rendered during the PHE would face the extra complexity to account for PHE waivers.

Inappropriate OIG Audit Practices

In recent years, the AHA has engaged in extensive discussions with CMS and the OIG to raise concerns about IRF and other audit practices. For example, the below sample of erroneous OIG auditing practices, originally described in an April 2018 letter from AHA to CMS, addresses practices that must be prevented in future audits and reviews:

- The OIG required hospitals to meet admission order requirements that were not in effect when the admission occurred — or that simply do not exist.

- Nearly every audit was subject to extrapolation, even if not statistically or legally sound. In fact, the OIG has stated that it now extrapolates its findings for all hospital audits. Notably, in one recent review, the OIG went a step further and extrapolated its findings to an entire Medicare administrative contractor jurisdiction.1

- The OIG has misapplied Medicare payment regulations to substantial denials, such as with transfers from general acute-care hospitals to a post-acute setting.2

Another source of concern was the OIG’s September 2018 report, Many Inpatient Rehabilitation Facility Stays Did Not Meet Medicare Coverage and Documentation Requirements. In a December 2018 letter to Daniel Levinson, former inspector general of HHS, AHA addressed the report’s erroneous conclusion that many IRF stays were not reasonable and medically necessary or lacked appropriate documentation. In this case, the OIG used independent medical review contractors and found that of the 220 cases that were reviewed, 4 out of every 5 should not have been paid by Medicare. The resulting 84% error rate found in these 220 cases was then extrapolated to the entire universe of Medicare IRF payments in 2013 — calculating an overall overpayment of $5.7 billion. The AHA identified serious flaws with this report, which, to our knowledge, were never addressed. We do recognize and sincerely appreciate ongoing efforts begun by CMS to engage on a proactive basis with the OIG on the audit issues discussed below. That said, it is unclear how fruitful those engagements might have been. To avoid furthering these serious problems, proactive, comprehensive and transparent process improvements are needed for all IRF and other audits, including to address these additional issues raised in our December 2018 letter:

- The OIG error rate in the report is wholly inconsistent with the CERT error rates for IRFs.3 This dramatic inconsistency warrants close examination of all CMS audit practices, including any gaps in IRF knowledge by auditors.

- While we were unable to validate these findings on a case-by-case basis, other IRF audits by the OIG have used problematic practices, such as inappropriately second-guessing the admitting physician’s judgment, relying on post-admission evidence, citing high function in one or two activities of daily living while ignoring others or ignoring other evidence in the medical record.

- Since OIG audits are not open to appeal, the report does not reflect the broader IRF overturn rate in the Medicare appeals process.4 We believe that the inability of IRFs to challenge audit findings before an error rate is calculated provides an inaccurate and misleading result.

- Extrapolation to the universe of IRF claims is improper and misrepresentative. By publishing the grossly exaggerated overpayment amount, the OIG impugned the value of the nearly 400,000 Medicare beneficiary IRF stays in 2013, even though these IRFs were denied their right to appeal.5

In a February 2019 letter from AHA to CMS, we thanked the agency for the work begun with the HHS OIG to coordinate potential audit areas before an audit begins, to help prevent misinterpretation of Medicare policies and to focus audits on CMS’ program integrity priorities. The AHA continues to support this action plan and its contemplated process improvements, and would appreciate a progress update. In that letter, AHA cited continuing examples of erroneous IRF audits:

- In its October 2018 compliance review of Mobile Infirmary Medical Center, the OIG deemed numerous IRF claims as wrongly billed. Ultimately, a different contractor re-reviewed the claims. The OIG agreed with the re-review findings that 50% of its reviewers' findings (8 out of 16) were incorrect. On their own, these mistakes, which the OIG itself acknowledged it made, warrant a pause on IRF audits to provide the opportunity to identify and address gaps in the audit process.

- In the OIG's Feb. 6, 2019, response to the above December 2018 letter from AHA, the OIG continued to confuse Medicare requirements, which only may be imposed by statute or regulation, with manual guidance in that it did not seem to understand that guidance interpreting statutory or regulatory requirements is not binding, but merely instructive. Unfortunately, it is quite possible that the OIG and other IRF auditors are continuing this erroneous practice.

Fluctuating CERT Audit Results for IRFs

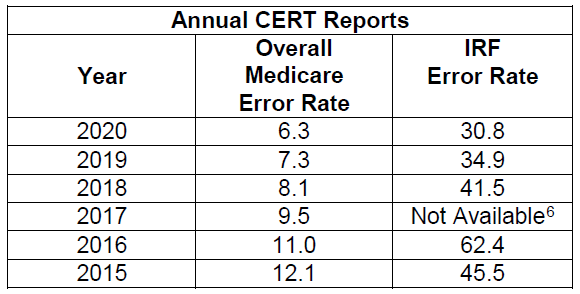

IRF audits by Medicare’s CERT contractor have produced inconsistent year-to-year results, which exacerbate existing doubts about Medicare auditors’ ability to conduct reliable program integrity audits of the IRF field. In addition, we note that the IRF fluctuations are in direct contrast to the steady decline of CERT’s overall Medicare error rate for the same time period. These divergent patterns justify a close investigation of the audit protocols used for IRFs and the related level of inter-rater reliability. These problems should neither be overlooked nor perpetuated through the IRF RCD proposal — rather, they should be resolved prior to implementing any new program integrity efforts for IRFs.

Also, we note that, as with the OIG audits, the CERT annual reports on improper payment fail to account for denials that are overturned on appeal, thereby providing an incomplete and misleading assessment of the field’s payment accuracy.

Inaccurate RAC Denials Yielded Extensive Appeals Activity

Since its introduction as a multi-state demonstration program in 2005, RACs have had a strong focus on IRF claims. In fact, the IRF experience with RACs also highlights the difficulty CMS has had in implementing accurate and reliable IRF audits. The initial RAC demonstration program in California had great difficulty achieving an acceptable level of IRF auditor knowledge, despite extensive communication with the AHA and other stakeholders, as well as targeted IRF auditor training by CMS. As a result, the contractor was required to place a hold on IRF audits to allow CMS to intervene. While this effort at quality assurance was appreciated, RAC audits ultimately have been a source of substantial denials over the years. This has contributed to the well-known appeals system backlog, which eventually led CMS to offer a settlement option to IRFs that would complete appeals adjudication outside of the formal appeals process, and help lighten the backlog.

DEMONSTRATION’S ACROSS-THE-BOARD DESIGN THREATENS ACCESS TO CARE AND IMPOSES UNWARRANTED ADMINISTRATIVE BURDEN ON IRFS WITH NO HISTORY OF NONCOMPLIANCE

We share CMS’ interest in ensuring that Medicare resources are sensibly used and reimburse services that are medically necessary. As such, we have extensively partnered with the agency on a host of persistent program integrity issues, including the CMS effort to improve IRF audits by the OIG, as shown above. However, the AHA is still greatly concerned that the proposed IRF RCD’s across-the-board approach would impose undue administrative burden on IRFs that have no history of noncompliance. These IRFs would still be subjected to 100% review, which will increase burden and divert critical resources away from patient care — a particular problem for patient access during the PHE. There is simply little justification for imposing such burdens on patients and providers in this way, and particularly at this time. Rather, if CMS wishes to proceed with this demonstration, it should rely on data-driven evidence to narrow the program’s scope by reducing the number of affected providers and claims for those providers.

An example of the substantial burden this rule would impose lies with the timelines CMS has set out. Specifically, based on the experience of our members in the home health RCD, we anticipate that many, and likely most, IRFs would elect the option that auditors review and approve claims prior to payment, in order to avoid the alternative 5% automatic reduction in payment. However, this process is unnecessarily long, increasing IRF costs of care prior to review results. Specifically, not only is the proposed five-day review period too long, but the pause in the five-day count for weekends is particularly egregious. If CMS moves forward with this demonstration, we strongly encourage it to require its contracted auditors to render IRF and other review results in the shortest time period possible, with no delay for weekends. These important adjustments would help IRFs continue to deliver patient-centered care in a timely way.

In addition, CMS’ documentation requirements are likely to impose burdens on providers down the road. For example, CMS only would require IRFs to submit a subset of a patient’s medical record; however, this, by definition, limits an auditor’s view of the patient. This limitation would likely, in turn, elevate the rate of inaccurate denials.

Finally, AHA members report that burden estimates in this proposal are greatly understated. In particular, the agency’s estimated resources for a non-physician to prepare a claim for review — 30 minutes (with wages of $34 per hour) — is not accurate. In fact, it is a particular underestimate for IRFs, given the complexity of the patients needing IRF care. Such complexity is reflected in typically dense IRF medical records, which capture the breadth of care provided during relatively long IRF stays. These stays average approximately 12 days and include care by a host of practitioners, such as the intensive therapies that are fundamental elements of every IRF stay. Another factor that increases total minutes per review beyond CMS’ underestimate is the extra time that hospital staff would need to ensure that PHE waivers are accurately described and accounted for.

OTHER CONCERNS

Finally, these additional concerns must be addressed, if a PAC PPS is ultimately implemented..

Lack of Detail on Transitioning from 100% Review to Spot Checks.

The notice’s two sentences explaining the proposed mechanism for IRFs that reach a 90% approval rate for reviewed claims to transition to “spot checks” falls short of the detail needed by stakeholders. In particular, further detail is needed on how providers that achieve this approval rate would transition to the proposed spot checks of a 5% sample, including the timeframe for moving to this second stage. These details would be particularly important for IRFs with no pattern of noncompliance, which would quickly qualify for this transition.

Payment Inaccuracies and Fraudulent Practices Require Separate Treatment

We ask that any future iteration of this type of demonstration establish two tracks that distinctly target fraud versus improper payments. In legal and regulatory terms, these two items are very different and should, at least in part, trigger different CMS interventions, rather being blended together, as in this proposal. This point is highlighted by CMS in the CERT, Medicare Fee-For-Service 2016 Improper Payments Report:

“It is important to note that while all payments made as a result of fraud are considered ‘improper payments,’ not all improper payments constitute fraud. Improper payments typically do not involve fraud. The improper payment rate is a measure of compliance with and adherence to federal rules and requirements and should not be viewed primarily as expenses that should not have occurred in the first place.”

As such, should CMS proceed with this proposal, the agency should apply data-based interventions using existing analytical tools in order to target fraud and noncompliance separately. Doing so is necessary to avoid penalizing providers with no pattern of noncompliance.

The Appeals Backlog is Improving But Still Substantial

The current appeals process for Medicare FFS claims remains under-resourced and, as a result, subject to a substantial backlog. While the backlog of IRF and other appeals is improving following legal action initiated by AHA, it is still a problem that substantially slows down appeals and, too often, delays final payment for medically necessary services rendered months or years in the past. In fact, in December 2020, HHS reported that the appeals system still had over 160,000 appeals pending. If implemented as proposed, the IRF RCD would only exacerbate the appeals backlog.

We thank you for the opportunity to comment on this information collection proposal for an IRF RCD. If you have any questions concerning our comments, please feel free to contact me, or have a member of your team contact Rochelle Archuleta, director of policy, at rarchuleta@aha.org or 202-626-2320.

Sincerely,

Stacey Hughes

Executive Vice President

Government Relations and Public Policy

______________

1 OIG, Corporate Integrity Agreement FAQ, https://oig.hhs.gov/faqs/corporate-integrity-agreements-faq.asp.

2 See OIG, Medicare Compliance Review of Carolinas Medical Center (January 2018), https://oig.hhs.gov/oas/reports/region4/41604049.pdf.

3 One possible explanation is that the OIG relied on provisions of the Medicare Benefit Policy Manual to determine coverage and documentation requirements for IRF stays despite the fact that manual guidance

is not binding. See Id. at 2; contra Clarian Health West LLC v. Hargan, 878 F.3d 346, 357 (D.C. Cir. 2017) (Medicare manual instructions issued without a notice-and-comment rulemaking “have no binding legal effect”). In addition, we note that the OIG attributes the large number of IRF claims for 2013 that were allegedly paid improperly, in part due to the fact that “CMS’s extensive educational efforts and recent post payment reviews were unable to control an increasing improper payment rate reported by CERT since our 2013 audit period.” But the OIG Report and CERT report that reached wildly divergent conclusions about the number of IRF claims that were improperly paid actually reviewed claims for the same year — 2013.

4 OIG findings are not appealable. This means that providers audited by the OIG have no way to vindicate their rights where they believe the OIG has erred. This also lends support to the AHA’s view, consistent

with the reasoning in Chaves County and other cases, that the audit findings should not be extrapolated unless protections exist.

5 Courts that have upheld sampling and extrapolation to determine overpayments on Medicare claims have done so only where there are protections in place. For example, in Chaves County Home Health Services v. Sullivan, the court recognized the importance of being able to challenge each individual claim denial as well as the statistical validity of the extrapolation. But none of the IRFs involved in the OIG audit had those rights.

6 In the 2017 CERT report, IRF data are not separately presented. Rather, they are grouped with long-term care hospital data in the “Non-IPPS Hospital” category under the “Hospital Inpatient (Part A)” sub-category.