Estimates of the value of federal tax exemption and community benefits provided by nonprofit hospitals, 2020

September 2024

EY was commissioned by the American Hospital Association to analyze the federal revenue forgone due to the tax exemption of nonprofit hospitals relative to the community benefits they provide1. This study presents estimates for 2020, the most recent year for which complete comparable community benefit information is available for nonprofit hospitals. The study is based on Medicare hospital cost reports for approximately 2,500 nonprofit general hospitals. The analysis does not account for other nonprofit specialty hospitals, such as psychiatric or long-term acute care.2

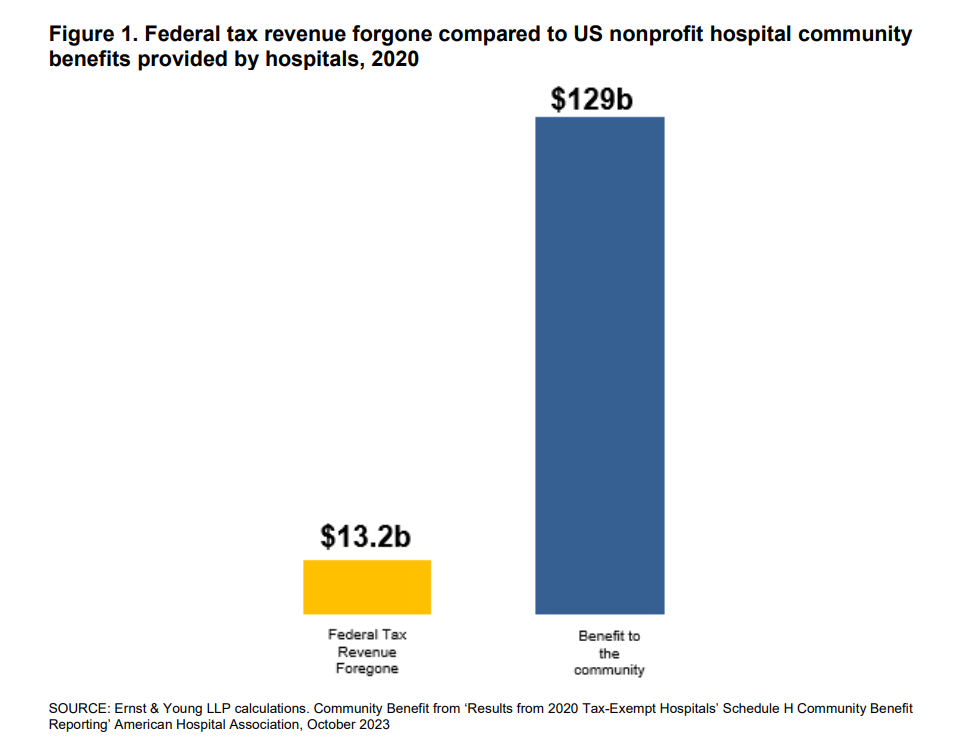

In 2020, the estimated tax revenue forgone due to the tax-exempt status of nonprofit hospitals is $13.2 billion. In comparison, the benefit tax-exempt hospitals provided to their communities, as reported on the Form 990 Schedule H, is estimated to be $129 billion, almost 10 times greater than the value of tax revenue forgone.

Federal revenue forgone from tax-exempt nonprofit hospitals in 2020

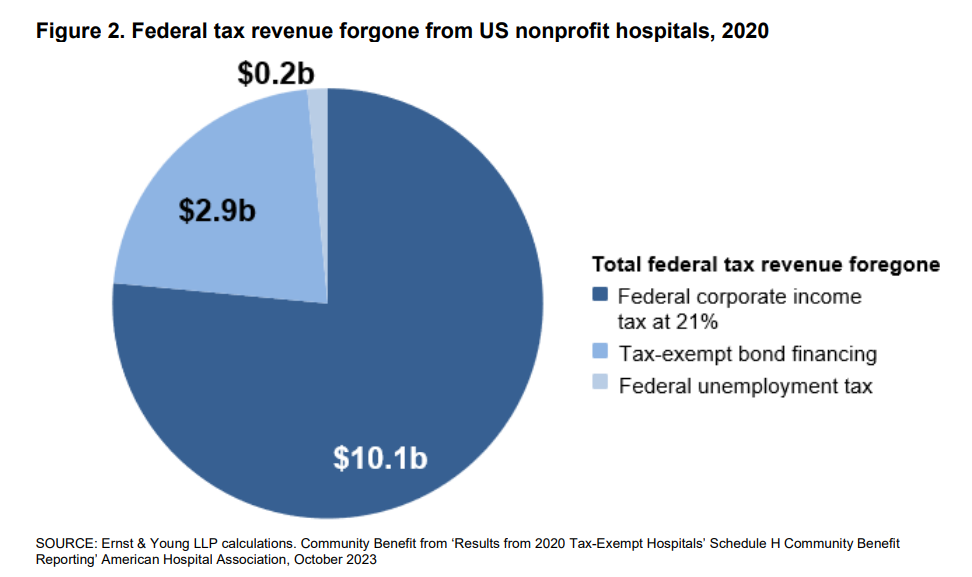

Three tax provisions that provide a federal exemption for nonprofit hospitals are analyzed here:

- ) Federal corporate income tax exemption;

- ) Tax-exempt bond financing; and

- ) Federal unemployment tax exemption.

Based on the data and methodology described below for nonprofit general hospitals, the value of the federal revenue forgone due to these three tax exemptions in 2020 is estimated to be $13.2 billion. This estimate reflects the upper bound of the potential value of the federal tax exemption for two reasons:

- ) Some hospitals may be exempt due to their educational or religious nature, rather than their charitable nature. In the absence of a tax exemption for charitable hospitals, certain organizations could continue to be exempted for other reasons.

- ) Certain features of the federal tax code are not reflected in this analysis due to a lack of necessary information, such as potential tax credits and accelerated depreciation.

Additionally, potential taxpayer behavioral changes may occur if hospitals were subject to tax. These effects would likely reduce taxable income but have not been reflected in this analysis.

Total community benefit provided by tax-exempt nonprofit hospitals in 2020

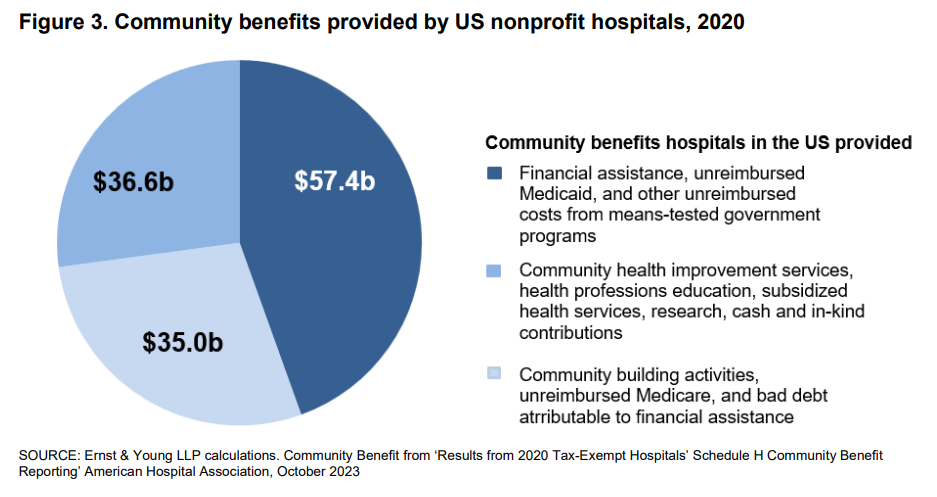

Four items are included in tax-exempt hospitals’ total benefit to communities reported on Form 990 Schedule H:

- ) Financial assistance and means tested government programs and other benefits (Part I, line 7k of the Form 990 Schedule H);

- ) Community-building activities (Part II of the Form 990 Schedule H);

- ) Medicare shortfall (Part III, line 7 of the Form 990 Schedule H); and

- ) Bad debt attributable to charity care (Part III, line 3 of the Form 990 Schedule H).

The total community benefit provided by tax-exempt hospitals is estimated to be $129 billion in 2020.

Figure 1 offers a comparison of the federal tax revenue forgone due to the tax benefits available to tax-exempt hospitals with the value of hospital-provided financial assistance and other community benefits. Total community benefits are calculated at cost for private nonprofit hospitals from the IRS Form 990 Schedule H.3

Figure 2 shows the makeup of the federal tax revenue forgone for 2020. Of the $13.2 billion of federal revenue forgone, $10.1 billion reflects federal corporate income taxes. Meanwhile, $2.9 billion reflects the reduced cost of tax-exempt financing, the direct benefits of which accrue to taxexempt bond holders. In return, these holders provide financing to the tax-exempt hospitals at a reduced interest rate. The revenue forgone due to federal unemployment tax exemption is $0.2 billion.

Figure 3 shows the makeup of the community benefits provided by tax-exempt hospitals in 2020. Of the $129 billion of community benefits, $57.4 billion reflects financial assistance, unreimbursed Medicaid, and other unreimbursed costs from means-tested government programs. In addition, $36.6 billion reflects community health improvement services, health professions education, subsidized health services, research, and cash and in kind contributions. $35.0 billion reflects community building activities, unreimbursed Medicare, and bad debt attributable to financial assistance.

Overview of approach for estimating federal tax revenue forgone

This analysis estimates federal tax revenue forgone as a result of three federal tax provisions, relying on data from the Medicare hospital cost reports filed by hospitals that receive Medicare reimbursements. The hospital cost reports are not audited financial reports, but they are filed by hospitals with the federal government. In 2020 – the year on which this analysis is based – 2,432 private, nonprofit, general hospitals filed Medicare hospital cost reports.4 The results are then grossed up to the entire field using data from the 2020 AHA Annual Survey of Hospitals and from the AHA Schedule H Community Benefit Reporting study.5

In this analysis, we apply the general federal tax rules to the levels of tax-exempt activities reported by nonprofit hospitals. Not all aspects of the detailed federal tax rules can be applied to the available financial data in the hospital cost reports, however, so certain estimates of revenue forgone require additional data and/or assumptions, which are described below.

Adjustments to reported income incorporated in the estimate of revenue forgone from corporate income tax exemption

The estimate of corporate taxable income starts with the positive net income before adjustments for each hospital as reported in the Medicare hospital cost reports. The cost reports, similar to financial reports, do not include the entire income and expense detail necessary to reconstruct a corporate income tax return. In estimating the interest deduction, the 50% limitation was used.6 Adjustments for positive and negative differences between book and tax accounting are not made due to insufficient detail in the Medicare hospital cost reports. For example, the provision for bad debt is likely to reduce financial statement income as compared with taxable income, while accelerated tax depreciation is likely to reduce taxable income as compared with financial statement income.

- Bonus depreciation not reflected. In 2020, federal tax law allowed bonus depreciation that provided additional first-year tax write-offs of capital investments as part of fiscal stimulus. Bonus depreciation applied to only certain qualifying property, and some state tax systems did not conform to this provision. Due to this complexity and data constraints, bonus depreciation was not considered in this analysis. Had bonus depreciation been reflected in the estimates, it would have reduced the federal corporate income tax forgone in 2020.

- Consolidation with affiliates. The analysis assumes that nonprofit hospitals would take advantage of tax consolidation rules with affiliated hospitals if they were subject to tax. Thus, a hospital with a taxable loss could offset positive taxable income of a consolidated hospital in the current year.7 Using an affiliation listing provided by the American Hospital Association, consolidated taxable income of all nonprofit hospitals was estimated. On net, consolidation of hospitals reduces overall taxable income.

- Contributions excluded from income. The analysis reduces hospitals’ taxable income by the amount of contributions received. If contributions constitute gifts for federal income tax purposes, such gifts are not included in taxable income but may be subject to gift tax. Restricted gifts used for capital improvements may not be included in taxable income if certain conditions are met, in which case they would reduce the taxable basis of the capital improvements. Further, if contributions to hospitals are not eligible for a tax deduction, it is assumed that most donors would choose other qualified organizations. For these reasons, the contributions are excluded from the estimate of corporate taxable income.

- State and local taxes. Many hospitals would automatically pay higher state and local taxes in the absence of the federal tax exemption. Thus, estimates on a state-by-state basis of the potential sales tax on business inputs and of potential property taxes on nonprofit hospitals were incorporated in the federal tax calculations as deductions from taxable income.8 Increased state corporate income taxes also would be deductible against federal taxable income, and this factor also is reflected in the analysis.

- Prior year losses. Finally, the federal corporate income tax does not tax businesses only on their net positive income in each year, but instead allows for net operating losses to offset taxable income to be carried forward offsetting positive taxable income in future years.9 For tax loss carryforwards, financial statement income losses from 2009 through 2019 were applied against positive taxable income for each year, with any remaining losses applied to positive income from 2020. The tax loss carryover rules, similar to the tax consolidation rules, result in taxable income being lower than positive financial net income in all years analyzed.

Tax-related items not considered for analysis

Several items were not included in the analysis due to information constraints. The items below would reduce the estimate of federal revenue forgone had they been included.

- Potential federal tax credits. The analysis does not include federal credits such as enterprise zone and work opportunity tax credits, and special deductions, such as accelerated depreciation, are not included in this analysis due to lack of necessary information.

- Routine tax planning. Taxable companies routinely plan their operations and structures to minimize tax, which could result in hospitals reporting lower taxable income than suggested by financial statements for exempt entities.

- Tax net operating losses. Losses that remained at the end of 2020 could be used by some hospitals to offset future taxable income, which have not been considered in this analysis.

- Unrelated business income tax. Some nonprofit hospitals already pay income tax on a small portion of their income.10 Had current payments of this tax been considered, the estimate of the value of foregone federal taxes would be reduced.

Impacts of the COVID-19 pandemic

Given the year of analysis was 2020, the financial information used in this analysis reflects the impacts of the COVID-19 pandemic. Due to the pandemic, the estimates of the value of tax exemption for 2020 may not be representative of past or future years.

Estimate of federal revenue forgone from tax-exempt bond financing

The analysis calculates the revenue forgone from tax-exempt bond financing to nonprofit hospitals. The estimate assumes the total amount of notes payable and other long-term liabilities outstanding as reported in the Medicare cost reports were issued as federally tax-exempt bonds. The analysis assumes that the average marginal tax rate applicable to investors in tax-exempt bonds is approximately 30 percent.11 Applying this tax rate to the 10-year average taxable yields of Aaa and Baa corporate bonds and tax-exempt debt outstanding in each of the years, the revenue forgone from tax-exempt bonds of nonprofit hospitals was $5.0 billion in 2020. To the extent that nonprofit hospitals are using short-term financing with lower yields, the revenue forgone would be lower.

It should be noted that the benefit received by the hospital issuer is likely smaller than the federal revenue forgone, as the amount of revenue forgone is dependent on all the marginal tax brackets of the investors, whereas the market-clearing interest rate may be for a lower marginal tax bracket than many of the other bondholders. Furthermore, investors may not convert the entire tax benefit they receive into a lower cost of financing for the hospital.

Estimate of the revenue forgone from federal unemployment tax

The value of the revenue forgone from the federal unemployment tax is calculated assuming an effective federal unemployment tax rate of 0.5 percent and a maximum wage base of $7,000 per employee. Based on the 4.7 million employees of private nonprofit hospitals, the value of the exemption from federal unemployment tax is estimated to be $165 million in 2020.12

Endnotes

1 The methodology used in this report is consistent with Ernst & Young studies previously completed on behalf of the American Hospital Association (released February 2013, October 2017, and May 2020).

2 AHA’s 2020 Annual Hospital Statistics Survey indicates there are 6,154 registered hospitals in the US. This includes community, federal government, psychiatric, long term care, and other hospitals. There are 5,194 community hospitals, which include non-governmental nonprofit (2,966 hospitals), investor-owned for-profit (1,258 hospitals), and state and local government (970 hospitals). The remaining 960 hospitals are made up of the federal government, psychiatric, long-term care, and other hospitals (e.g., prison hospitals).

3 Community Benefit from ‘Results from 2020 Tax-Exempt Hospitals’ Schedule H Community Benefit Reporting' American Hospital Association, October 2023

4 Hospitals were identified based on AHA’s 2020 Annual Hospital Statistics Survey. The Survey defines a general medical hospital as follows: “Provides acute care to patients in medical and surgical units on the basis of physicians’ orders and approved nursing care plans.” In terms of the hospitals used for this analysis, there were 2,432 hospitals in the 2020 Medicare hospital cost reports.

5 This gross up is done by taking the federal revenue forgone as a percent of total hospital expense for the 2,432 hospitals in the CMS data. The community benefit data from the IRS Form 990 Schedule H already includes a percent of total hospital expense calculation. The total hospital expense number from the AHA Survey of Hospitals for 2020 for nonprofit general medical hospitals is used to calculate the total revenue forgone and community benefits dollars. This makes comparable the tax savings and community benefits calculations.