CMS Releases Hospital Inpatient PPS Proposed Rule for Fiscal Year 2024

AHA Special Bulletin

April 11, 2023

The Centers for Medicare & Medicaid Services (CMS) April 10 issued its hospital inpatient prospective payment system (PPS) and long-term care hospital (LTCH) PPS proposed rule for fiscal year (FY) 2024. This Special Bulletin reviews highlights of the inpatient PPS provisions in the rule, while the LTCH PPS provisions are covered in a separate Special Bulletin.

The rule proposes a net 2.8% rate increase for inpatient PPS payments in FY 2024. This 2.8% payment update reflects a hospital market basket increase of 3.0% as well as a productivity cut of 0.2%. It would increase hospital payments by $3.3 billion, minus a proposed $115 million decrease in disproportionate share hospital payments (largely due to a decrease in the uninsured) and proposed $460 million decrease in new technology add-on payments.

Key Highlights

The proposed rule would:

- Increase inpatient PPS payment rates by a net 2.8% in FY 2024.

- Continue the low wage index hospital policy for FY 2024, treat rural reclassified hospitals as geographically rural for the purposes of calculating the wage index, and exclude “dual reclass” hospitals from the rural wage index.

- Allow graduate medical education payments to be made to Rural Emergency Hospitals to support graduate medical training in rural areas.

- Reinstate program integrity restrictions for physician-owned hospitals approved as “high Medicaid facilities.”

- Add fifteen new MS-DRGs and delete sixteen MS-DRGs.

- Add a new health equity adjustment and a sepsis bundle measure to the Hospital Value-based Purchasing Program.

- Permit the use of web-based surveys for Hospital Consumer Assessment of Healthcare Providers and Systems.

- Require reporting of “up to date” vaccination status for the Inpatient Quality Reporting health care personnel COVID-19 vaccination measure.

- Seek information on supporting safety-net providers.

AHA TAKE

We remain extremely disappointed with CMS’ woefully inadequate proposed payment update of only 2.8% of FY 2024. This payment update fails to account for the record-high inflation and persistent labor, supply and drug costs the hospital field has experienced in the last two years and continues to face currently. Once again, we will urge CMS and the Administration to rectify shortcomings in its previous payment updates and to more appropriately support the field. Without a more substantial update in the final rule, Medicare’s chronic underpayments to hospitals threaten their ability to continue caring for patients and providing essential services for their communities. See AHA’s full statement that was shared with the media.

Highlights of the inpatient PPS rule follow.

FY 2024 IPPS PROPOSED CHANGES

Inpatient PPS Payment Update

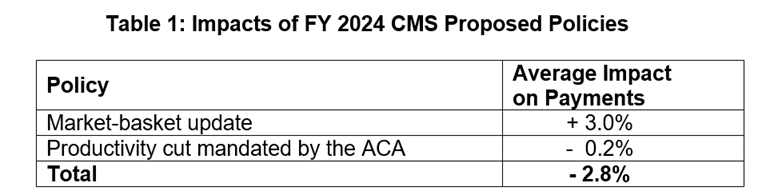

The proposed rule would increase inpatient PPS rates by a net of 2.8% in FY 2024, compared to FY 2023, after accounting for inflation and other adjustments required by law. Specifically, CMS proposes an initial market-basket update of 3.0%, less 0.2 percentage points for productivity, as required by the Affordable Care Act (ACA). Table 1 below details the impact of proposed policies.

Additionally, hospitals not submitting quality data would be subject to a one-quarter reduction of the initial market basket and, thus, would receive an update of 2.05%. Hospitals that were not meaningful users of electronic health records in FY 2020 would be subject to a three-quarter reduction of the initial market basket and, thus, would receive an update of 0.55%. Hospitals that fail to meet both of these requirements would be subject to a payment decrease of 0.2%.

For rate-setting purposes, CMS proposes to use FY 2022 MedPAR claims and FY 2021 cost report data, as it ordinarily would have done. Unlike the previous two years, CMS is not proposing any modifications to its usual rate-setting methodologies to account for the impact of COVID-19.

Disproportionate Share Hospital (DSH) Payment Changes

Under the DSH program, hospitals receive 25% of the Medicare DSH funds they would have received under the former statutory formula (described as “empirically justified” DSH payments). The remaining 75% flows into a separate funding pool for DSH hospitals. This pool is updated as the percentage of uninsured individuals changes and is distributed based on the proportion of total uncompensated care each Medicare DSH hospital provides.

For FY 2024, CMS estimates the empirically justified DSH payments to be $3.41 billion. It estimates the 75% pool to be approximately $10.22 billion. After adjusting this pool for the percent of individuals without insurance, CMS estimates that it will total approximately $6.71 billion. This results in a decrease in DSH and uncompensated care payments of $115 million, largely due to an estimated decrease in the uninsured.

In order to distribute the 75% pool, the agency proposes to continue to cost report data on uncompensated care. Specifically, it would use a three-year average of the three most recent fiscal years for which audited cost report data are available. Last year, CMS used S-10 data from FY 2018 and 2019 cost reports to determine the distribution of DSH uncompensated care payments for FY 2023.

Area Wage Index

CMS makes several proposals in the rule around the area wage index, which adjusts payments to reflect differences in labor costs across geographic areas. First, the agency proposes to continue its low-wage-index hospital policy as established in the FY 2020 final rule. It notes that the Bridgeport Hospital, et al., v. Becerra court ruling found that the secretary did not have authority to adopt the low wage index policy, but that the agency is now appealing the decision and would continue the policy for FY 2024. Under this policy, for hospitals with a wage index value below the 25th percentile, the agency would continue to increase the hospital’s wage index by half the difference between the otherwise applicable wage index value for that hospital and the 25th percentile wage index value for all hospitals. As it has done previously, the agency would reduce the FY 2024 standardized amount for all hospitals to make this policy budget neutral.

Second, CMS has previously made policy changes in reaction to numerous courts’ decisions related to the rural wage index and rural floor. In this year’s rule, CMS states that it has taken the opportunity to revisit the case law, public comments and statutory language. Specifically, the agency proposes to include the data from §412.103 hospitals that reclassified from urban to rural in the calculation of the rural wage index. (Last year, the agency finalized the inclusion of these hospitals in the calculation of the rural floor, but not in the calculation of the rural wage index.) Further, the agency is proposing to exclude “dual reclass” hospitals, those with simultaneous §412.103 and Medicare Geographic Classification Review Board reclassifications, from the calculation of the rural wage index.

Medicare Graduate Medical Education (GME)

To increase access to physicians in rural areas, CMS is proposing to allow Rural Emergency Hospitals (REHs) to train residents and receive GME payments. Specifically, beginning on or after Oct. 1, 2023, an REH can include full-time equivalent (FTE) residents training at the REH in its direct GME and indirect medical education (IME) FTE counts for Medicare payment purposes. Alternatively, an REH can also incur direct GME costs and be paid based on reasonable costs for those training.

Additionally, CMS is proposing methods to implement payments for nursing and allied health (NAH) education programs. Medicare pays providers for Medicare’s share of the costs that providers incur in connection with approved education activities, including NAH programs. The total spending for these programs is capped at $60 million for any calendar year (CY). Section 4143 of the Consolidated Appropriations Act (CAA) 2023 stipulated that this limit would not apply for CY 2010-2019 to correct for the agency’s mistake in the application of the cap in previous years. CMS is now implementing Section 4143 of the CAA and will correct payments made to providers in the relevant years, as appropriate.

COVID-19 Treatments Add-on Payment (NCTAP)

CMS states that if the public health emergency ends May 2023, as planned by the Department of Health and Human Services, discharges involving eligible products would continue to be eligible for the NCTAP through Sept. 30, 2023 (that is, through the end of FY 2023). After that time, however, NCTAPs and no NCTAP would be made beginning in FY 2024 (that is, for discharges on or after Oct. 1, 2023).

MS-DRG Classification Changes Analysis

CMS is proposing fifteen new MS-DRGs and the deletion of sixteen MS-DRGs, many of which are in MDC 05 (Diseases and Disorders of the Circulatory System).

Recalibration of the FY 2024 MS-DRG Relative Weights

CMS previously used a proxy of standardized drug charges of less than $373,000 to identify clinical trial claims and expanded access use claims when calculating the average cost for MS-DRG 18 (Chimeric Antigen Receptor (CAR) T-Cell and other immunotherapies). Instead, CMS proposes to no longer use the proxy of standardized drug charges of less than $373,000 to identify clinical trial claims and expanded access use cases when calculating the average cost for MS-DRG 018. The agency proposes to modify the calculation of the adjustment to account for the CAR T-cell therapy cases identified as clinical trial cases in calculating the national average standardized cost per case that is used to calculate the relative weights for all MS-DRGs.

Complication/Comorbidity (CC) and Major Complication/Comorbidity (MCC) Analysis

CMS continues to solicit feedback regarding the nine guiding principles that, when applied, could assist in determining whether the presence of the specified secondary diagnosis would lead to increased hospital resource use in most instances. Additionally, CMS continues to encourage feedback related to other possible ways to incorporate meaningful indicators of clinical severity. That said, other than proposed severity level changes related to three Social Determinants of Health ICD-10-CM homelessness codes and the addition of four unspecified diagnosis codes that were inadvertently omitted from the edit implemented April 1, 2022, CMS is not proposing additional changes for FY 2024 as the comprehensive CC/MCC analysis work continues.

Application of the non-CC Subgroup Criteria and Detailed Data Analysis

In the FY 2021 rule, CMS finalized a proposal to expand existing criteria to create a new CC or MCC subgroup within a base MS-DRG which included the expansion of the criteria to encompass the non-CC subgroup for a three-way severity level split. Consistent with FY 2022 and 2023 proposals, CMS proposes to continue to delay application of the non-CC subgroup criteria to existing MS-DRGs with a three-way severity level split for FY 2024. CMS continues to have interest in comments for consideration in the FY 2025 proposed rule.

Physician Self-referral Law: Physician-owned Hospitals

In the proposed rule, CMS reiterates that it has the discretion to approve or deny requests for expansion exceptions for physician-owned hospitals. The proposed rule clarifies that CMS will only consider expansion exception requests from eligible hospitals, specifies the data and information that must be included in requests, and also identifies the process/factors for requests.

In addition, the proposed rule reinstates program integrity restrictions for physician-owned hospitals approved as “high Medicaid facilities” (which had been removed in the CY 2021 outpatient PPS final rule). The agency states that reinstatement of program integrity restrictions would ensure consistency between both applicable hospitals and high Medicaid facilities. Specifically, CMS proposes reinstatement of:

- Restrictions to expansion that would result in a hospital’s facility capacity exceeding 200% of its baseline facility capacity, including consideration of any prior expansion exception approvals when determining maximum facility capacity.

- Limitation of requests for expansion exceptions to once every two years.

- Restrictions on the location where expansion could occur to only the hospital’s main campus.

Hospital Quality Reporting and Value Programs

CMS proposes significant changes its hospital quality reporting and value programs.

Hospital Value-based Purchasing (HVBP) Program. Beginning with the FY 2026 program year, CMS proposes to adopt a health equity adjustment (HEA) that would add bonus points to a hospital’s VBP Total Performance Score. CMS believes the HEA would reward high quality performance for hospitals caring for underserved patient populations. The HEA would be based on a combination of a hospital’s quality performance and the extent to which it cares for underserved patients. The HEA would be the product of two factors — a “measure performance scaler” and “an underserved multiplier.” The measure performance scaler assigns hospitals points based on whether they score in the top, middle or bottom third of performance on each HVBP measure domain. The underserved multiplier is based on the proportion of a hospital’s inpatient stays that are for patients that are dually eligible for Medicare and Medicaid.

CMS also proposes to:

- Add one new measure — severe sepsis and septic shock management bundle — beginning with the FY 2026 HVBP program;

- Modify the Medicare Spending per Beneficiary (MSPB) measure by allowing readmissions to trigger new episodes starting with the FY 2028 program year;

- Include new conditions in the total knee arthroplasty/total hip arthroplasty (THA/TKA) complication measure beginning with the FY 2030 program year; and

- Make several changes to administration process for Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) survey starting with the CY 2025 reporting/FY 2027 payment year. This includes permitting the use of web-based surveys, allowing a patient’s proxy to respond to surveys and requiring hospitals to collect information about the language the patient speaks while in the hospital.

Inpatient Quality Reporting (IQR). CMS proposes to add three new electronic clinical quality measures (eCQMs) measures to the IQR program beginning with the CY 2025 reporting/FY 2027 payment year. The three measures below would be added to the menu of available eCQMs from which hospitals may self-select to fulfill eCQM reporting requirements for both the IQR and the Hospital Promoting Interoperability program:

- Hospital harm — pressure injury eCQM

- Hospital harm — acute kidney injury eCQM

- Excessive radiation dose or inadequate image quality for diagnosis computed tomography (CT) in adults eCQM

Beginning with Q4 2023 reporting, CMS also proposes to update its Healthcare Personnel (HCP) COVID-19 vaccination measure to require hospitals to report on the cumulative number of HCP that meet the Centers for Disease Control and Prevention’s definition of “up to date” on their COVID-19 vaccinations. CMS also proposes to include Medicare Advantage patients in calculating performance on its hybrid hospital-wide all-cause mortality and readmission measures. CMS also proposes the same modifications to the HCAHPS survey administration process that it proposes for the HVBP.

Lastly, CMS proposes to remove three measures from the IQR:

- THA/TKA complications, since the updated version of the measure is proposed for the HVBP program;

- MSPB, because the updated version of the measure has been proposed for the HVBP program; and;

- Elective delivery prior to 39 weeks gestation (PC-01), because measure performance is topped out.

Request for Information: Safety-Net Hospitals

As a result of Executive Order 13985 on “Advancing Racial Equity and Support for Underserved Communities through the Federal Government,” the proposed rule includes a request for information (RFI) on how CMS can support safety-net providers. The agency discusses two approaches in defining and supporting safety-net providers, including those proposed by the Medicare Payment Advisory Commission’s safety-net index and the use of other types of area-level indices such as the Area Deprivation Index. For example, the RFI seeks comments on how safety-net hospitals should be defined, what are the challenges they face, and what new approaches or modifications to existing approaches could be implemented to address those challenges.

FURTHER QUESTIONS

CMS will accept comments on the inpatient PPS proposed rule through June 9. The final rule will be published around Aug. 1, and the policies and payment rates will take effect Oct. 1. Watch for a more detailed analysis of the proposed rule in the coming weeks.

If you have further questions, contact Shannon Wu, AHA’s senior associate director of policy, at 202-626-2963 or swu@aha.org.