Partnerships, Mergers, and Acquisitions Can Provide Benefits to Certain Hospitals and Communities

Introduction

Hospitals and health systems face many pressures to increase the scale of their operations

Demographic and economic forces are increasing the percentage of patients who are beneficiaries of Medicare or Medicaid. Because these programs pay below hospitals’ cost of care, hospitals must seek efficiencies of scale to drive down costs and minimize their losses. Larger organizations also can spread fixed costs across a greater number of facilities, lowering per unit costs of care.

Hospitals and health systems are assuming risk under valuebased payment programs designed to drive down the total cost of care. Assumption of risk requires a patient population large enough to diversify risk and absorb the impact of high-risk, high-acuity patients.

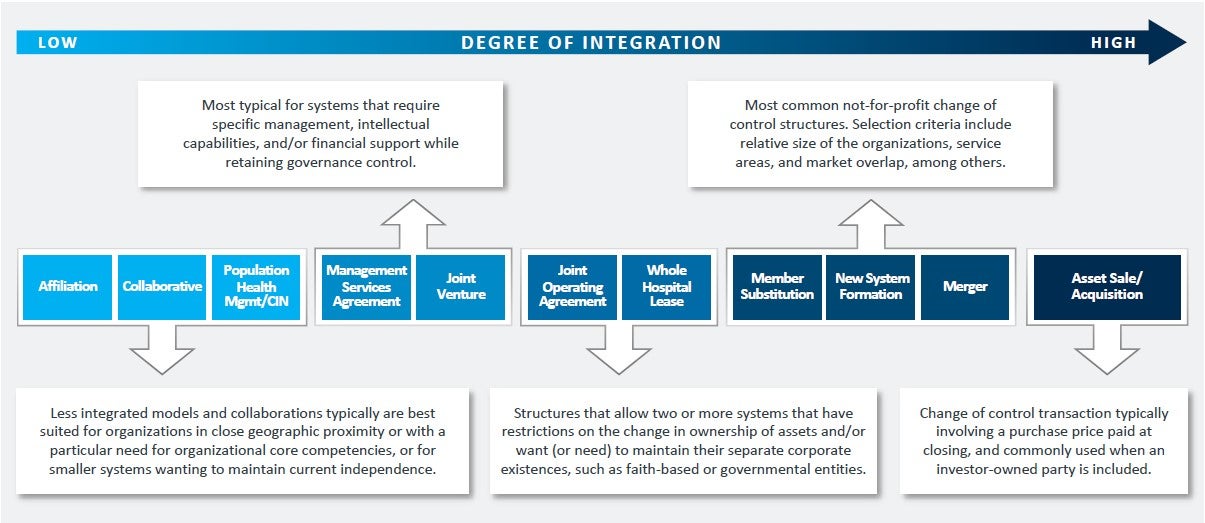

To help mitigate these challenges, hospitals are considering a range of partnership, merger, and acquisition possibilities to gain new capabilities, realize new efficiencies, and spread costs over a larger organization. As illustrated in the spectrum of opportunities on p. 7, hospitals considering these possibilities may pursue less integrated affiliations and partnerships or more highly integrated mergers and acquisitions.

The ongoing movement of care from inpatient to outpatient settings has opened healthcare to a new class of competitors who do not bear the high costs of providing acute-care services. These new competitors include major national retail chains and tech giants, whose scale and financial resources dwarf those of even the largest health systems. Health systems must increase scale to access capital on competitive terms. Moreover, scale helps health systems attract the intellectual talent necessary to innovate in competitive outpatient services, while maintaining access to—and enhancing the quality of—the acute-care services that they exclusively provide to their communities.

The COVID-19 pandemic has had a devastating financial impact on hospitals and health systems. Prior to the pandemic, about 25% of hospitals had negative operating margins. At the beginning of 2021, almost one year after the pandemic took hold in the U.S., half of hospitals had negative margins, the result of significant volume declines and increased pandemic-related costs.

Legislative and regulatory change could create new financial pressures on hospitals. These changes include site-neutral payment policy proposals, efforts to limit discounts under the 340B Drug Pricing Program, and scheduled Medicaid Disproportionate Share Hospital (DSH) and Medicare sequester payment cuts.

The impact of these forces has transformed healthcare

- As of July 26, 2021, the Cecil G. Sheps Center for Health Services Research at the University of North Carolina reports that 138 rural hospitals have closed since 2010. A new record was set in 2020, with 19 rural hospital closures, driven by low patient volumes, heavy reliance on Medicare and Medicaid payments, and new financial pressures resulting from the pandemic.

- An analysis of AHA and Kaufman Hall data suggests that almost 40% of hospitals may be financially challenged or distressed prior to an M&A transaction.

For some hospitals, partnerships, mergers, and acquisition are a necessary response to these forces and have provided many benefits to patients and communities

- They have saved certain hospitals from closure—even some of the most financially distressed organizations—preserving and often enhancing patient access to care

- They have given health systems the scale needed to:

- Provide resources to support consumer-centric strategies that enhance the patient experience of care

- Engage in partnerships with health plans and large employers to improve the accessibility and affordability of care

- Obtain capital at an affordable cost to make investments in care delivery advances, technology, and population health infrastructure

- They have assisted in efforts to reduce costs while enhancing the quality of patient care

Integration models reflect hospitals’ and health systems’ strategic goals

Horizontal integration models between hospitals and health systems can range from looser affiliations to full acquisitions. Strategic goals of horizontal integration include:

- Increasing geographic coverage within a market to offer sufficient breadth of access to potential insurer or employer partners seeking new health plan options for their members or employees

- Bringing specialty services or management capabilities to hospitals in new markets, which expands access to healthcare services and enhances operational efficiencies

- Combining systems with complementary capabilities that can enhance care delivery, manage alternative payment model risk, or improve operations across the combined entities

Vertical integration models between hospitals and health systems and other providers (e.g., physician groups, post-acute care facilities, behavioral health services) can also range from affiliations to acquisitions. Strategic goals of vertical integration include:

- Expanding patient access to services across the care continuum

- Building care networks to coordinate patient care under risk-bearing value-based payment models

The degree of integration is determined by a range of factors

A hospital that lacks strong management capabilities in behavioral health, for example, may enter a joint venture partnership with a skilled behavioral health operator.

A merger or acquisition may be more appropriate for a financially distressed hospital that requires major capital investment and management oversight from the acquiring hospital.

Source: Kaufman, Hall & Associates, LLC.

To read the full report, click on the PDF link below.

|

© 2021 Kaufman, Hall & Associates, LLC. All Rights Reserved. This article may not be mass produced or modified without the express written consent of Kaufman, Hall & Associates, LLC.

Latest AHA Hospital Financial Reports

Financial Effects of COVID-19: Hospital Outlook for the Remainder of 2021

The Effect of COVID-19 on Hospital Financial Health

COVID-19 in 2021: Pressure Continues on Hospital Margins Report

COVID-19 in 2021: The Potential Effect on Hospital Revenues

The Effect of COVID-19 on Hospital Financial Health

New AHA Report Finds Losses Deepen for Hospitals and Health Systems Due to COVID-19

Hospitals and Health Systems Face Unprecedented Financial Pressures Due to COVID-19