AHA Summary of Hospital Inpatient PPS Final Rule for Fiscal Year 2022

AHA Special Bulletin

August 3, 2021

Medicare & Medicaid Services (CMS) Aug. 2 issued its hospital inpatient prospective payment system (PPS) and long-term care hospital (LTCH) PPS final rule for fiscal year (FY) 2022. In addition to finalizing a 2.5% increase in inpatient PPS payments for 2022 and other policies, the rule repeals the requirement to report certain payer-negotiated rates and makes changes to quality measurement and value programs. Highlights of the proposals related to the LTCH PPS are covered in a separate Special Bulletin. The regulations take effect Oct. 1.

AHA Take

We appreciate CMS listening to our concerns by repealing the requirement that hospitals and health systems disclose privately negotiated contract terms with payers on the Medicare cost report. We also are pleased that the agency recognizes that the COVID-19 pandemic has resulted in non-representative performance in its hospital quality measurement and value programs, requiring temporary policy adjustments. While CMS’ new quality measure on the rate of health care personnel COVID-19 vaccination likely needs further refinement to ensure it accurately reflects hospitals’ progress in vaccinating their workforce, we will work with CMS, CDC and hospitals to facilitate the reporting of the measure starting on Oct. 1. Lastly, we appreciate that CMS is continuing to review comments on its organ acquisition and Medicare-funded residency slot proposals. We look forward to working with the agency to develop workable policies. See AHA’s full statement that was shared with the media here.

Highlights of the inpatient PPS rule follow.

Inpatient PPS Payment Update

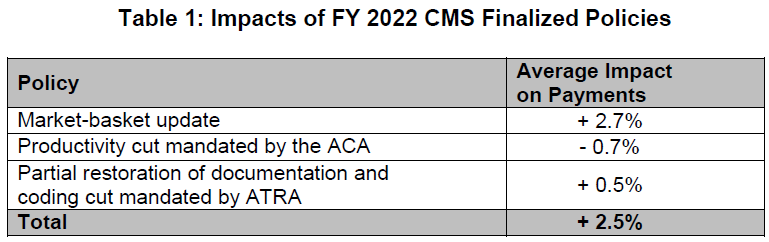

The final rule will increase inpatient PPS rates by a net of 2.5% in FY 2022, compared to FY 2021, after accounting for inflation and other adjustments required by law. Specifically, the update includes an initial market-basket update of 2.7%, less 0.7 percentage points for productivity required by the Affordable Care Act (ACA), and plus 0.5 percentage points to partially restore cuts made as a result of the American Taxpayer Relief Act (ATRA) of 2012. Table 1 below details the factors CMS includes in its estimate.

The ACA and ATRA adjustments will be applied to all hospitals. Additionally, hospitals not submitting quality data will be subject to a one-quarter reduction of the initial market basket and, thus, will receive an update of 1.83%. Hospitals that were not meaningful users of EHRs in FY 2019 will be subject to a three-quarter reduction of the initial market basket and, thus, will receive an update of 0.48%. Hospitals that fail to meet both of these requirements will be subject to a full reduction of the initial market-basket rate and receive an update of -0.20%.

In light of the COVID-19 PHE, CMS finalized that it will use FY 2019 data in approximating expected FY 2022 inpatient hospital utilization for rate-setting purposes.

Market-based MS-DRG Data Collection and Weight Calculation

CMS finalized its repeal of the requirement that hospitals report their median payer-specific negotiated rates for inpatient services, by Medicare Severity-Diagnosis Related Group, for Medicare Advantage organizations. It also repealed the market-based MS-DRG relative weight methodology CMS had planned to implement in FY 2024; instead, CMS will continue using its existing cost-based methodology.

Disproportionate Share Hospital (DSH) Payment Changes

Under the DSH program, hospitals receive 25% of the Medicare DSH funds they would have received under the former statutory formula (described as “empirically justified” DSH payments). The remaining 75% flows into a separate funding pool for DSH hospitals. This pool is updated as the percentage of uninsured individuals changes and is distributed based on the proportion of total uncompensated care each Medicare DSH hospital provides. For FY 2022, CMS estimates the 75% pool to be approximately $10.48 billion. After adjusting this pool for the percent of individuals without insurance, CMS estimates the uncompensated care amount to be approximately $7.19 billion, a decrease of roughly $1.1 billion compared to FY 2021.

The agency finalized that it will use a single year of uncompensated care data from Worksheet S-10 to determine the distribution of DSH uncompensated care payments for FY 2022. Specifically, CMS will use S-10 data from FY 2018 cost reports, which the agency has recently audited.

Maintenance of the ICD-10-CM and ICD-10-PCS Coding Systems

CMS is adopting an April 1 implementation date for ICD-10-CM and ICD-10-PCS code updates, in addition to the annual October 1 update, beginning with April 1, 2022. CMS acknowledges the concerns expressed by the AHA with respect to potential operational issues and with commercial payers and compliance issues. CMS intends to work with stakeholders and identify how the agency can address issues that may arise in this process.

Complication/Comorbidity (CC) and Major Complication/Comorbidity (MCC) Analysis

In the proposed rule CMS solicited comments on adopting a change to the severity level designation of the 3,490 “unspecified” diagnosis codes currently designated as either CC or MCC, where there are other codes available in that code subcategory that further specify the anatomic site, to a Non-CC for FY 2022. If approved, the change would have affected the severity level assignment for 4.8% of the ICD-10-CM diagnosis codes. However, for FY 2022, CMS is maintaining the severity level designation of all “unspecified” diagnosis codes on Table 6P.2a. Instead, CMS is finalizing the Unspecified Code Medicare Code Editor edit which CMS believes provides additional time to educate coders on updated coding guidelines and offer assistance to providers on proper documentation while not affecting the payment the provider is eligible to receive.

In addition, at the AHA’s recommendation, 58 ICD-10-CM diagnosis codes will not be included for consideration of changing the severity level designation as part of the list of “unspecified” diagnosis codes. The 58 diagnosis codes include malignant neoplasms, occipital fractures, spinal fractures and other internal injuries that cannot be visualized externally.

New Technology Add-on Payment (NTAP)

The inpatient PPS provides additional payments, known as NTAPs, for cases with relatively high costs involving eligible new medical services or technologies. For FY 2022, in connection with CMS’ use of the FY 2019 instead of FY 2020 data for rate setting, the agency finalized a one-year extension of NTAPs for 13 technologies for which the payments would otherwise be discontinued beginning FY 2022.

New COVID-19 Treatments Add-on Payment (NCTAP)

In response to the pandemic, CMS established the New COVID-19 Treatments Add-on Payment (NCTAP) for eligible discharges during the PHE. CMS is extending the NCTAP for eligible COVID-19 products through the end of the fiscal year in which the PHE ends. Hospitals will be eligible to receive both NCTAP and the traditional NTAP for qualifying patient stays, through the end of the fiscal year in which the PHE ends.

Area Wage Index

CMS finalized several policies around the area wage index, which adjusts payments to reflect differences in labor costs across geographic areas. First, the agency will continue its low-wage-index hospital policy as established in the FY 2020 final rule. Specifically, for hospitals with a wage index value below the 25th percentile, the agency will continue to increase the hospital’s wage index by half the difference between the otherwise applicable wage index value for that hospital and the 25th percentile wage index value for all hospitals. As it has done previously, the agency will reduce the FY 2022 standardized amount for all hospitals to make this policy budget neutral.

Second, as required by the American Rescue Plan Act, CMS will permanently reinstate a minimum area wage index for hospitals in all-urban states, known as the “imputed rural floor.” Previously, for FYs 2019 – 2021, hospitals in all-urban states received a wage index without the application of an imputed floor. Per the law, this reinstated policy is not budget neutral and does not require reductions to the standardized amount.

Third, as a result of adopting updates from the Office of Management and Budget’s (OMB’s) core-based statistical area modifications, CMS last year finalized a policy to cap any decrease in a hospital’s final FY 2021 wage index compared to its final FY 2020 wage index at 5%. This was set to expire at the end of FY 2021. However, CMS is extending this cap through FY 2022 for hospitals that received it in FY 2021. Specifically, it will apply a 5% cap on any decrease in those hospitals’ wage index compared to FY 2021. CMS is applying this policy in a budget-neutral manner.

Finally, CMS is finalizing provisions in the interim final rule it published concurrently with the FY 2022 proposed rule, which will make technical amendments to current regulations related to how certain hospitals can be reclassified through the Medicare Geographic Classification Review Board.

Indirect and Direct Medicare Graduate Medical Education (GME)

CMS proposed to implement several provisions of the Consolidated Appropriations Act, including its requirement for 1,000 new Medicare-funded medical residency positions, the Promoting Rural Hospital GME Funding Opportunity, which would allow certain rural training hospitals to receive a GME cap increase, and the determination of direct GME per-resident amounts and certain full-time equivalent (FTE) resident limits for hospitals that host a small number of residents for a short duration. The agency stated that due to the number and nature of the comments it received on the implementation these programs, it will address these policies in future rulemaking.

Organ Acquisition Payment

CMS proposed to codify into Medicare regulations some longstanding Medicare organ acquisition payment policies, as well as some new policies, including clarifying definitions of “transplant hospital,” “transplant program” and “organs.” In addition, CMS proposed that transplant hospitals and organ procurement organizations count and report Medicare usable organs to ensure such organs are accurately allocated to Medicare. Lastly, the agency also proposed several provisions for donor community hospitals, including reducing its customary charges to its costs.

The agency stated that due to the number and nature of the comments it received on these payment policies, it will address these policies in future rulemaking.

Medicare Shared Savings Program (MSSP)

Due to the uncertainty of the COVID-19 pandemic, CMS will allow accountable care organizations (ACOs) participating in the “BASIC” track’s glide path to forgo automatic advancement and once again “freeze” their participation for performance year (PY) 2022 at their PY 2021 level. CMS first finalized such a policy in last year’s physician fee schedule final rule, allowing ACOs to freeze their PY 2020 participation level and avoid automatic advancement in PY 2021. ACOs that froze their participation for PY 2021 at their PY 2020 level will now be permitted to freeze their participation a second time, thus remaining at their PY 2020 participation level for PY 2022. Any ACO that elects to remain at its current participation level for PY 2022 will be automatically advanced to the BASIC track level in which it would have participated during PY 2023 if it had advanced automatically in PY 2022 (unless the ACO chooses to advance more quickly).

For example, an ACO that participated in BASIC Level A for PY 2020 and did not freeze its participation level would have automatically advanced to BASIC Level B in PY 2021. If that ACO elects to remain at Level B for PY 2022, instead of advancing to Level C, it would automatically advance to Level D for PY 2023. Similarly, if an ACO participated in BASIC Level A for PY 2020 and did elect to freeze its participation level, it would have participated in BASIC Level A in PY 2021. If that ACO again elects to remain at Level A for PY 2022, it would automatically advance to Level D for PY 2023.

Promoting Interoperability Program

CMS finalized proposals to continue the 90-day reporting period for calendar year (CY) 2023 and to increase the reporting period to 180-days for CY 2024. Consistent with policies for the Merit-based Incentive Payment System (MIPS) Promoting Interoperability category, CMS will maintain the Query of Prescription Drug Monitoring Program measure as optional while increasing available bonus points from 5 points to 10 points and add a new, optional Health Information Exchange Bi-Directional Exchange measure as a yes/no attestation beginning in CY 2022. Despite concerns raised by AHA, CMS finalized proposals to require eligible hospitals and critical access hospitals to attest to having completed an annual assessment of all nine Safety Assurance Factors for EHR Resilience (SAFER) Guides and increase the minimum required score from 50 points to 60 points (out of 100 points) to be considered a meaningful EHR user.

Hospital Quality Reporting and Value Programs

CMS finalized a number of significant policy changes to account for the impact of the COVID-19 PHE on its hospital quality reporting and value programs. The agency also adopted five new measures for the inpatient quality reporting (IQR) program, while removing three current IQR measures.

Measure Suppression Policy. In light of the COVID-19 PHE, CMS finalized a measure suppression policy that it will use across all of its hospital quality measurement and value programs. Under the policy, CMS will “suppress” (i.e., not use) measure data it believes have been affected by COVID-19 in calculating hospital performance. The agency’s goal is to ensure hospitals are not rewarded or penalized for their performance based on non-representative quality data affected by the pandemic. The suppression policy will be applied to several programs, as described below.

Hospital Value-based Purchasing (HVBP). CMS will suppress most of the HVBP program’s measures for FY 2022, including the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) measures, Medicare Spending per Beneficiary, and five health care associated infection measures. As a result, CMS believes it cannot calculate fair scores for hospitals nationally, and all hospitals will receive neutral payment adjustments under the VBP for FY 2022. However, CMS will calculate and report measure scores publicly where feasible and appropriate.

For the FY 2023 HVBP program, CMS will suppress the pneumonia mortality measure, and remove the claims-based patient safety indicator (PSI 90) from the HVBP program permanently.

Hospital Readmissions Reduction Program (HRRP). For the FY 2023 HRRP, CMS will suppress the pneumonia readmissions measure, and exclude COVID-19 diagnosed patients from the remaining five measures.

Hospital Acquired-Condition (HAC) Reduction Program. CMS finalized its proposal to suppress performance data from the third and fourth quarters of 2020 in calculating HAC Reduction Program performance for FYs 2022 and 2023. When combined with the waiver of the first two quarters of 2020 data CMS adopted last year, hospital HAC scores for FYs 2022 and 2023 will be based on truncated performance periods.

Inpatient Quality Reporting (IQR). CMS finalized its proposal to add five new measures to the IQR program. Most notably, CMS adopted new measures reflecting COVID-19 vaccination coverage among health care personnel and adoption of practices to reduce maternal morbidity. Both measures must be reported starting on Oct. 1. CMS also finalizes the removal of three IQR measures. However, based on stakeholder feedback, the agency will retain two measures it had proposed for removal – anticoagulation therapy for atrial fibrillation/flutter electronic clinical quality measure (STK-03) and the death rate among surgical inpatients with serious treatable complications (PSI-04). Beginning in CY 2023, hospitals will be required to report the IQR’s eCQMs using certified EHR technology consistent with 2015 Edition Cures Update.

NEXT STEPS

The final rule will be published in the Aug. 13 Federal Register and provisions will generally take effect Oct. 1. Watch for a more detailed AHA analysis of the final rule in the coming weeks.

If you have further questions, contact Shannon Wu, AHA senior associate director of policy, at 202-626-2963 or swu@aha.org.

Key Takeaways

CMS’ finalized policies will:

- Increase inpatient PPS payments by 2.5% in FY 2022.

- Repeal the requirement to report the median payer-specific negotiated rates for inpatient services, by Medicare Severity-Diagnosis-related Group (MS-DRG), for Medicare Advantage organizations.

- Use data from Worksheet S-10 in the FY 2018 cost report to determine the distribution of FY 2022 DSH uncompensated care payments.

- Extend New COVID-19 Treatments Add-on Payments for eligible COVID-19 products through the end of the fiscal year in which the public health emergency (PHE) ends.

- Change the Promoting Interoperability Program, including requiring a 180-day reporting period for CY 2024 and increasing the minimum required score to be considered a meaningful electronic health records (EHR) user.

- Suppress certain measures in hospital quality reporting and value programs, applying neutral payment adjustments under hospital value-based purchasing (VBP) for FY 2022, to account for the impact of the COVID-19 PHE.

- Adopt a measure reflecting COVID-19 vaccination coverage among health care